“The market is growing up. And the math proves it.”

Introduction

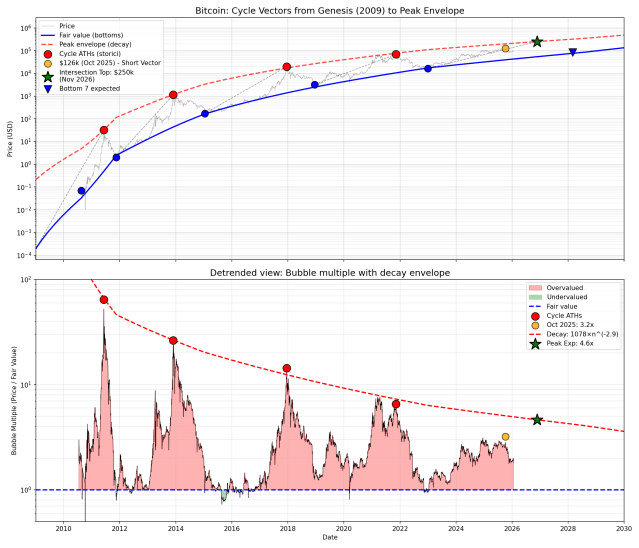

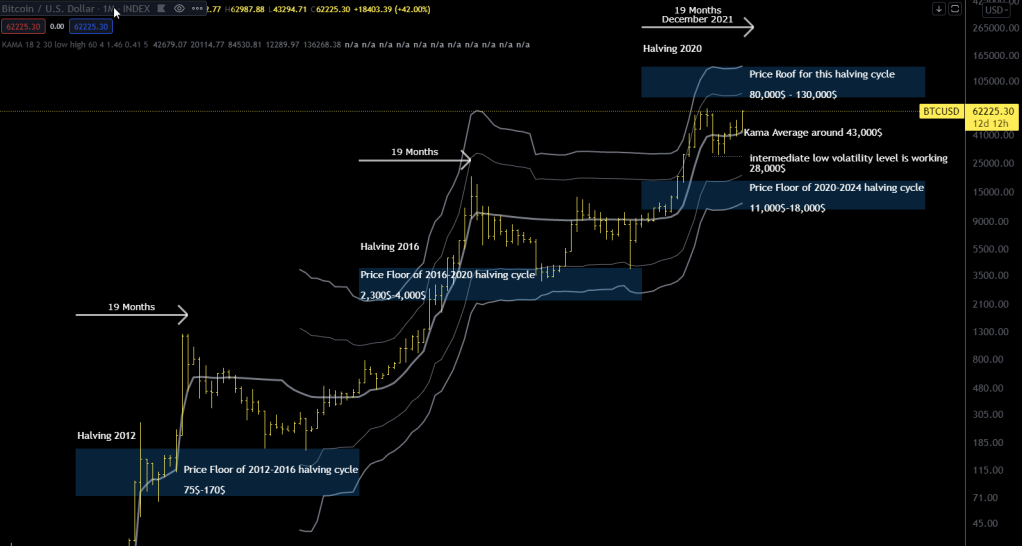

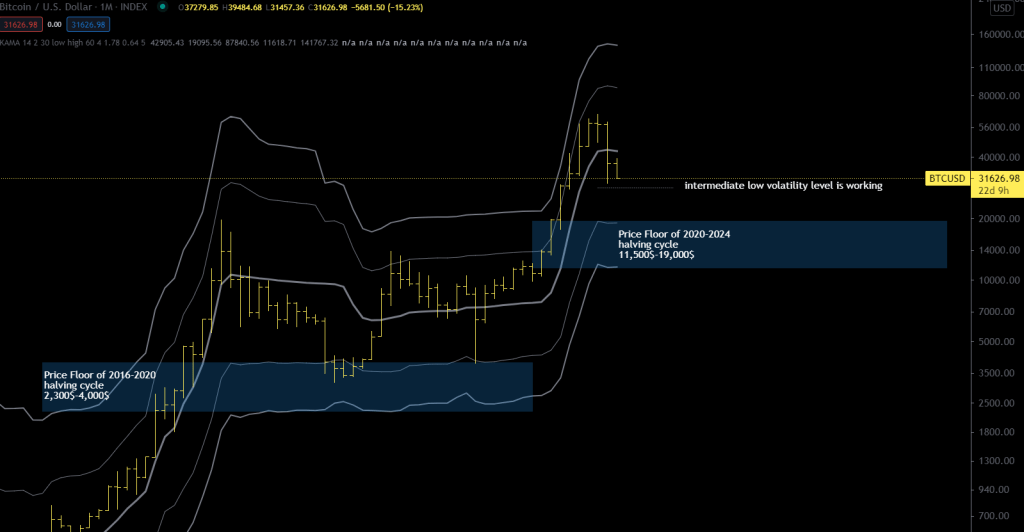

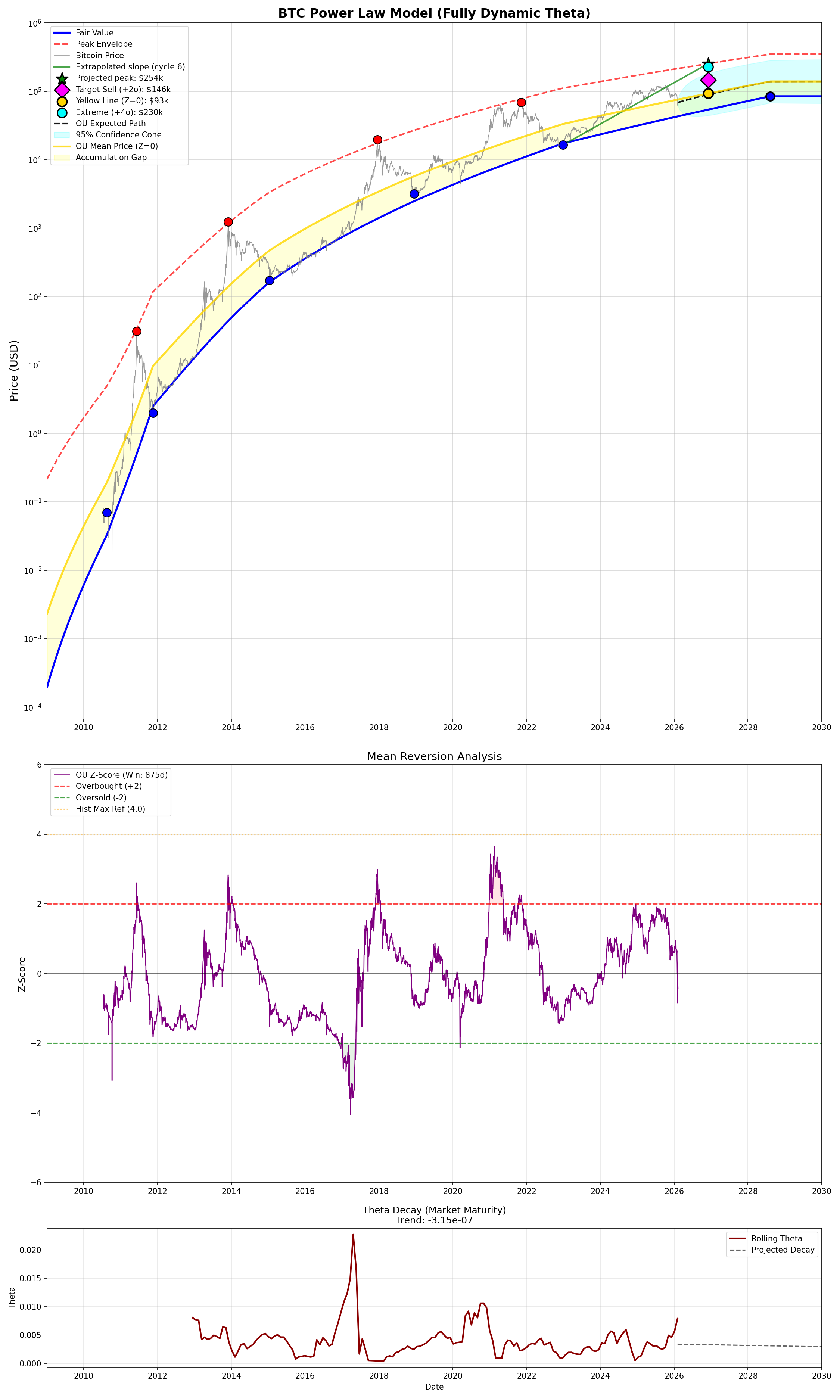

Most Bitcoin models rest on a simple observation: price, on a logarithmic scale, grows roughly linearly over time. That’s the famous Power Law. And it works, as a starting point.

But there’s a problem. A model that only draws a line (or a curve) on a chart tells you where the price should be on average but it tells you nothing about what happens when price deviates from it. It doesn’t tell you whether it will come back, with what force, or how long it will take.

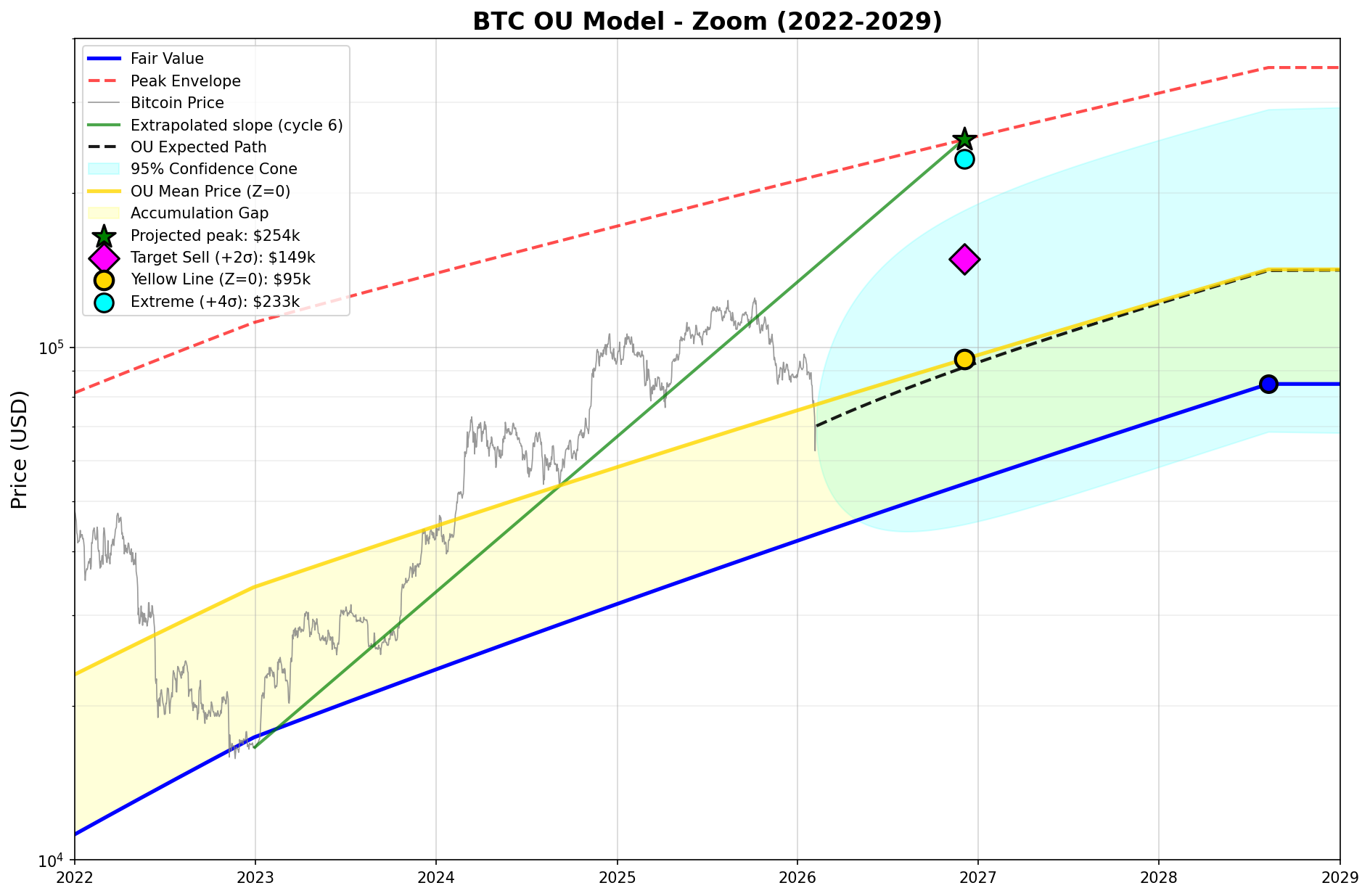

This article introduces a different framework without replacing the Power Law: it uses it as a foundation and builds on top of it a physical process called Ornstein-Uhlenbeck (OU), which describes exactly that return mechanism. The result is a model that not only estimates “fair value”, but quantifies the gravitational force pulling price back to equilibrium and, most importantly, measures how that force is changing over time.

This post is meant as a companion to the latest updates on the model page: Beyond the Power Law: A Two-Phase Model for Bitcoin Cycle Bottoms. If you haven’t read that yet, start there for the full context on the two-phase fair value model and cycle projections. What follows here focuses specifically on the mean reversion dynamics layered on top of that structure.

The Ornstein-Uhlenbeck Process, Explained Simply

Imagine a ball attached to a rubber band. The band is fixed to a central point (the equilibrium mean). If you pull the ball away from the center and let go, the band pulls it back. The further you pull it the stronger the return force and once the ball returns to center, it doesn’t stop perfectly: it oscillates back and forth, with the amplitude decreasing over time.

This is exactly the dynamics of the OU process, captured in one formula:

dX = θ(μ − X) dt

Where:

X is the current position of price (in relative terms within the channel between fair value and peak envelope).

μ (mu) is the equilibrium point, the center of the rubber band. In the model, this is the Yellow Line.

θ (theta) is the stiffness of the rubber band. The higher theta is, the faster price gets pulled back to center. The lower it is, the more freely price can wander.

The term (μ − X) is the distance from center. If price is above μ, this term is negative and pulls price down. If it’s below, it’s positive and pulls it up. The force always points toward center, in both directions, with equal intensity. This is the symmetry of the OU process.

The Two Gravitational Forces

This is the core insight of the model. Bitcoin’s price is not subject to one force, but two, and they have completely different natures.

First gravity: Theta (symmetric)

This is the rubber band force just described. It operates in both directions with equal intensity. When price is above the Yellow Line (OU Mean) theta pulls it down and when it’s below, theta pulls it up, theta has no directional preference: it’s a pure centering force.

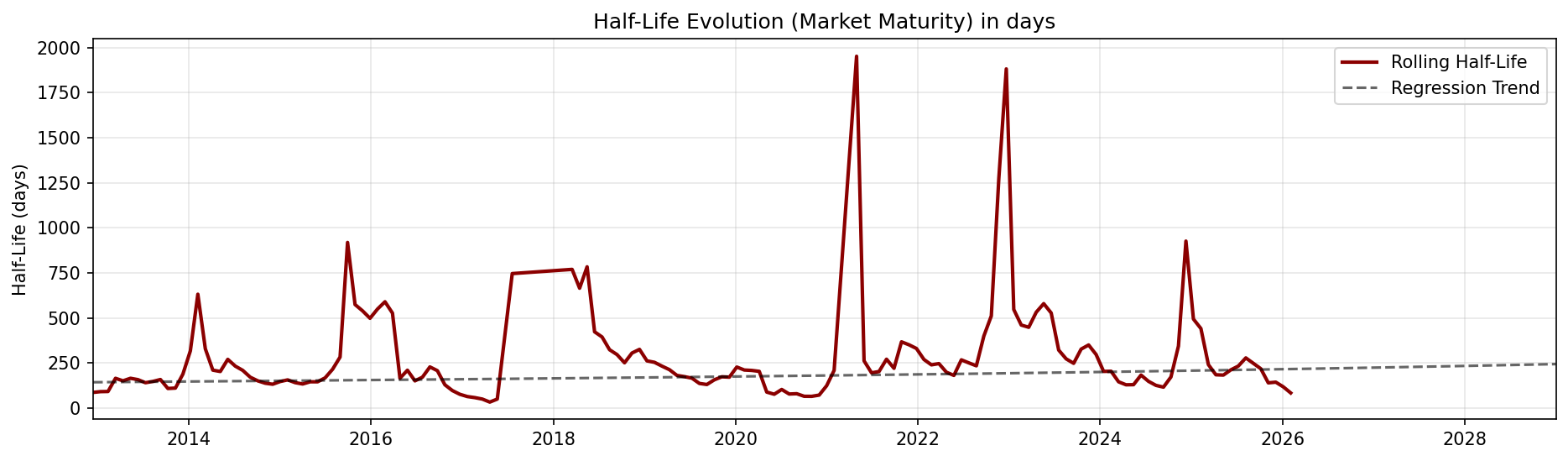

In the current model, the historical average theta is 0.00279, corresponding to a half-life of about 248 days (more on this below). The most recent rolling theta is significantly higher at 0.00831, indicating the current market is correcting faster than the historical average.

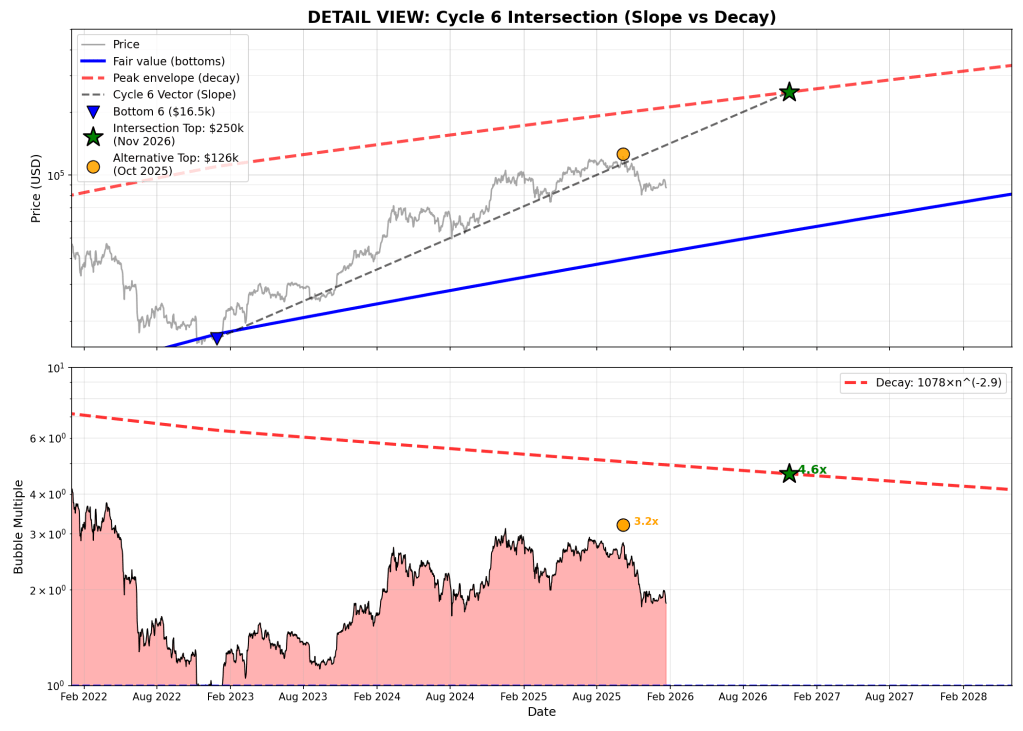

Second gravity: The Fair Value Floor (asymmetric)

The blue line on the chart is the Fair Value, computed from the two-phase Power Law. This line rises continuously over time and acts as a structural floor. It is not a symmetric force: it only acts from below. Price can rise as far as it wants above the Yellow Line (though theta will slow it down), but it can hardly stay below Fair Value for sustained periods.

The interaction between the two forces

The combined effect creates an asymmetric dynamic even though theta itself is symmetric. Here’s why:

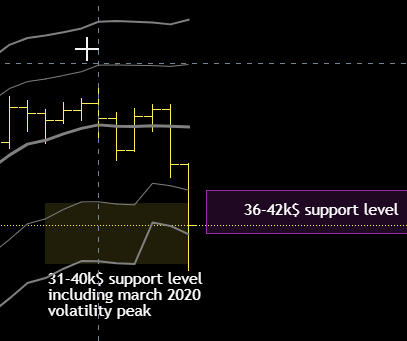

The Yellow Line (μ) sits structurally above Fair Value. In the model, μ = 0.3621, meaning the OU equilibrium point sits at 36% of the logarithmic channel between Fair Value and Peak Envelope. Not at the midpoint, not at the bottom: shifted upward relative to the floor.

This creates a crucial zone on the chart, the Accumulation Gap (yellow area): the space between the blue Fair Value and the Yellow Line. In this zone, both gravitational forces work in the same direction: theta pulls up (toward the yellow) and the floor prevents further descent (toward the blue). This is where price finds the strongest support.

Above the Yellow Line, only theta acts (pulling down). Below Fair Value, price is in “impossible” territory for prolonged periods, as the market’s very structure pushes recovery.

Half-Life: How Long It Takes to “Come Back”

Half-life is the most counterintuitive concept in the model, but also the most useful for trading. Let’s break it down.

What it means

Half-life is the time it takes for the distance between price and the Yellow Line to halve. It’s not the time to return to the mean. It’s the time to cover half the distance.

Concrete example: suppose price is $40,000 above the Yellow Line. With a half-life of 248 days (the model’s historical average), after about 8 months price will still be $20,000 above the mean. After another 8 months, $10,000 above. And so on. Each period halves the remaining distance, but never fully eliminates it.

Why it works this way

It’s the exponential nature of the process. The return force is proportional to the distance: when you’re far away the force is strong and the return is fast, as you get closer the force weakens and the return slows down. It’s exactly like the rubber band: the first centimeters snap back quickly, the last ones are painfully slow.

Mathematically: t½ = ln(2) / θ ≈ 0.693 / θ

What it tells us today

The model produces two half-life readings:

Historical half-life (global average): 248 days (~8.3 months). This is the average correction speed observed across Bitcoin’s entire history. It includes the wild cycles of 2011-2013 and the more orderly post-2015 ones.

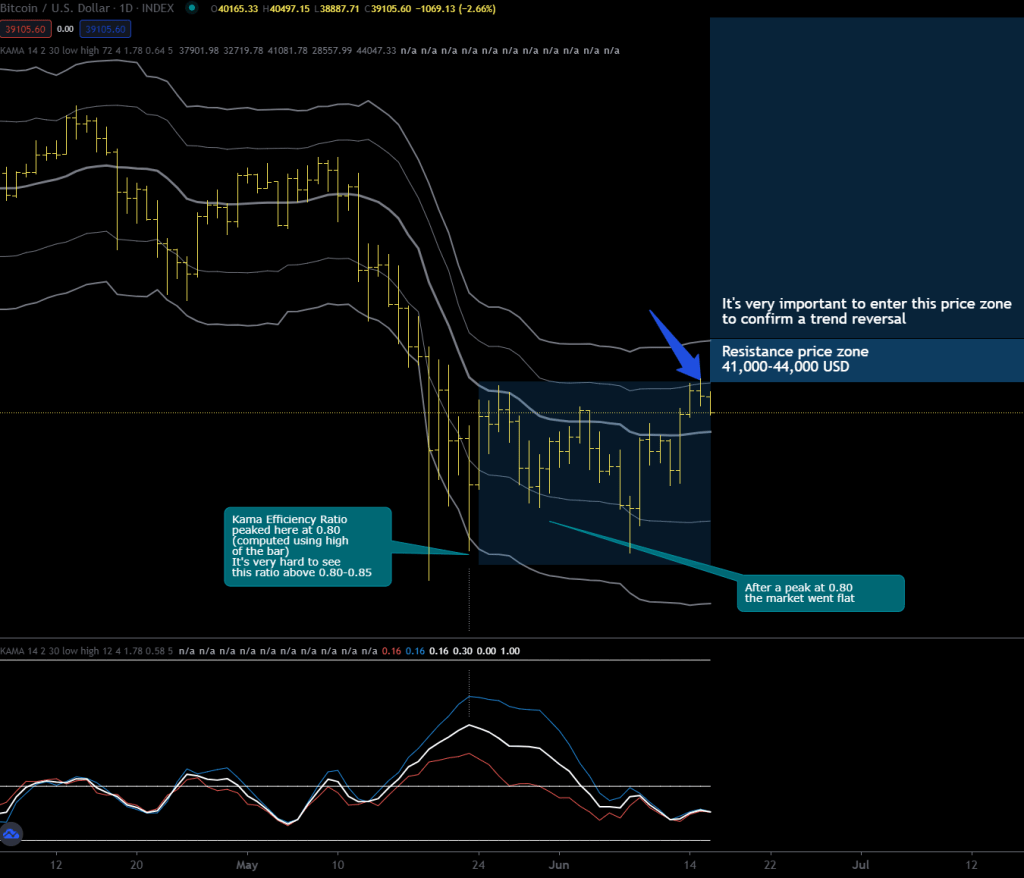

Current rolling half-life: 83 days (~2.8 months). The current market is correcting almost three times faster than the historical average. Rolling theta is 0.00831, equal to 297% of the average. This indicates a market where deviations from the mean get absorbed rapidly: less prolonged euphoria, less prolonged depression.

Trading implication

A short half-life means opportunity windows are shorter. If price hits an extreme (e.g. Z-Score +2 or -2), you don’t have months to decide, the mean reversion process is already underway, and the half-life tells you how quickly the window is closing.

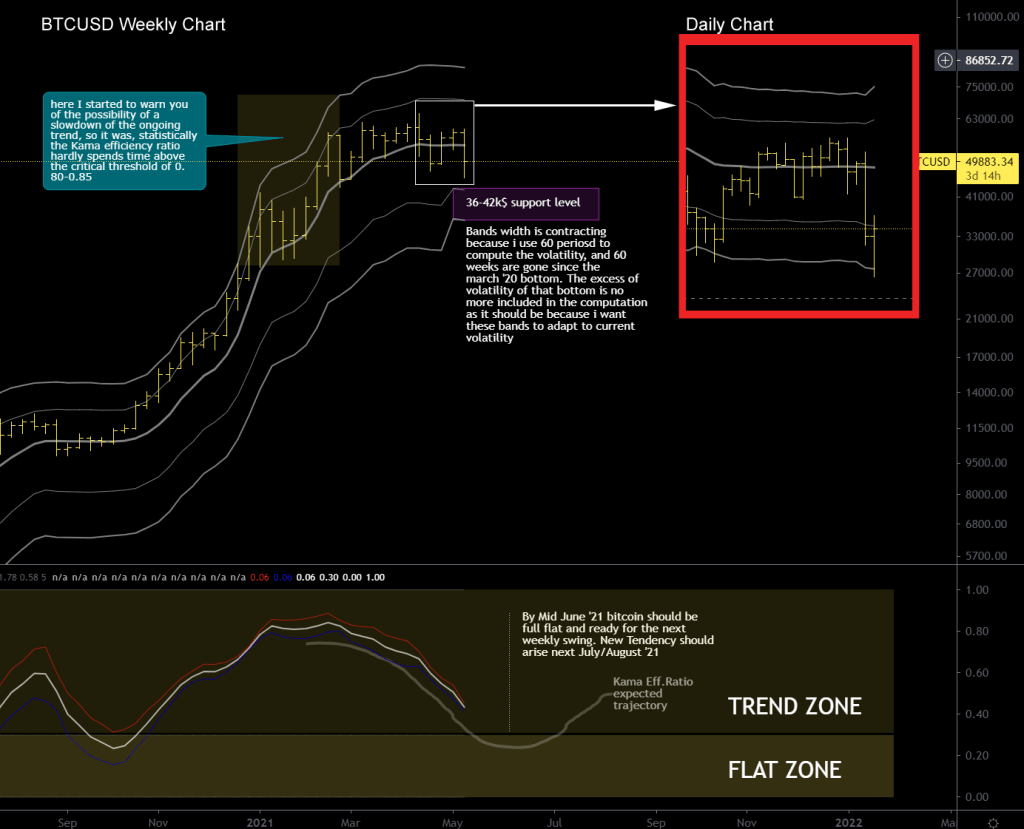

Rolling Theta and Market Maturity

The third panel of the chart shows theta’s evolution over time, computed on rolling windows of 875 days (~2.4 years). The trend line (dashed black) has a negative slope: -3.42 × 10⁻⁷ per day.

What does this mean in practice? Theta is slowly declining. The market is becoming less reactive over the long run. Future corrections will, on average, be slower. The structural half-life will lengthen.

This is the mathematical signature of Bitcoin’s maturation as an asset class. A young, speculative market has high theta: prices explode and crash rapidly. A mature market has low theta: movements are more gradual, cycles are smoother.

The model uses this trend to project theta into the future: from 0.00321 today to 0.00272 by 2030. This dynamic directly feeds the confidence cone in the main chart: the cone widens over time not because of generic uncertainty, but because the gravitational force keeping price near the mean is getting weaker.

Note: the trend line slopes upward because half-life is the inverse of theta. As theta decays (market maturing), the time to mean-revert increases.

Note: the trend line slopes upward because half-life is the inverse of theta. As theta decays (market maturing), the time to mean-revert increases.

Z-Score and Trading Targets

The middle panel of the chart shows the Z-Score, which measures how many standard deviations price is from the Yellow Line. The optimal window (875 days) was calibrated to produce a historical maximum of Z ≈ 4.0, corresponding to the extreme peaks of past bubbles.

Current status (February 7, 2026)

| Metric | Value |

|---|---|

| BTC Price | $70,154 |

| Fair Value | $43,157 |

| Yellow Line (Z=0) | $77,296 |

| Current Z-Score | -0.41 |

Price is slightly below the Yellow Line, in neutral territory with a mild undervaluation. It sits within the Accumulation Gap, the zone where both gravitational forces support price.

Current trading targets (February 7, 2026)

| Level | Price | Meaning |

|---|---|---|

| Target Sell (+2σ) | $123,539 | Distribution zone. Where you can start thinking to scale down your position. |

| Yellow Line (Z=0) | $77,296 | Equilibrium. The center of gravity. |

| Target Buy (-2σ) | $48,363 | Aggressive accumulation zone. |

| Panic (-3σ) | $38,255 | Rare event. Extreme buying opportunity. |

Targets at projected peak (December 2026)

| Level | Price |

|---|---|

| Extreme (+4σ) | $233,067 |

| Target 1st Sell (+2σ) | $148,523 |

| Yellow Line (Z=0) | $94,647 |

| Peak Envelope | $253,818 |

The projected peak at ~$250k represents the theoretical maximum where the cycle 6 slope intersects the decay envelope. But reaching the envelope requires a +4σ event, which has become increasingly rare as the market matures. The Z-Score at +2 sigma ($148k) is the rational distribution signal: it captures most of the upside without betting on an extreme that theta decay is actively working against.

OU Projection and Confidence Cone

The Expected Path (dashed black line on the chart) is not a price prediction. It’s the path price would follow if driven only by mean reversion, with no external shocks. It shows where gravity wants to take price.

The Confidence Cone (cyan area) represents the 95% interval of possible trajectories. It widens over time for two reasons: accumulated uncertainty and, most importantly, the progressive decay of theta which weakens the centering force.

In the short term (2026), the cone is relatively tight because theta keeps oscillations contained. In the long term (2028-2029), the cone opens as variance accumulates over time, which is a standard property of the OU process. Theta decay contributes marginally to this widening, as the decline rate is very slow (about 15% over four years), but the cumulative effect over long horizons is visible.

Conclusion: The New Normal

The model tells a coherent story. Bitcoin is transitioning from speculative asset to institutional asset. The math confirms it through three converging signals:

Theta decreases over time, meaning corrections slow down and cycles smooth out. Half-life lengthens, opportunity windows become more predictable but also shorter in relative terms. Fair value rises continuously and the Yellow Line with it, progressively raising the structural floor.

Pure speculation, the “buy at X and wait for 100X” kind, is mathematically in decline. The market will still move in cycles, but the multiples will compress and oscillations will be contained by an ever-present gravity.

For the trader, the message is clear: the $254k projected peak remains the theoretical cycle top where slope meets decay envelope. But the OU model adds a layer of risk management on top of that projection. Z-Score at +2 sigma ($148k) is the level where a disciplined, partial distribution makes sense. If price pushes to +4σ and hits the envelope, great. But sizing your entire exit strategy on a single extreme target is a bet against mean reversion. The model suggests scaling out, not going all-in on one number.

Data as of February 7, 2026. Model: BTC Power Law + Ornstein-Uhlenbeck with dynamic theta. Full code available on request.