Bull! Bull! Bull! BUY BUY BUY! Yes i know you are reading this all the time on many bitcoin related forums where there is the perma-bull or his alter ego “the perma-bearish guy” crying all the time that we are in a bubble.

Bull! Bull! Bull! BUY BUY BUY! Yes i know you are reading this all the time on many bitcoin related forums where there is the perma-bull or his alter ego “the perma-bearish guy” crying all the time that we are in a bubble.

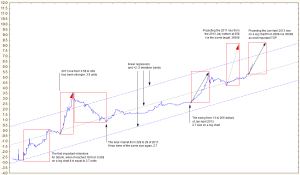

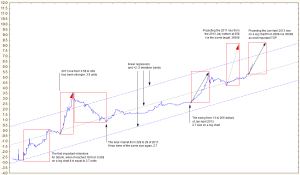

Well, personally i consider a stock or whatever you want in a bubble when it is very far away from a long term regression line. What does it mean “very far away”? When the observation is outside a statistically significant “prediction interval”. In statistical inference, specifically predictive inference, a prediction interval is an estimate of an interval in which future observations will fall, with a certain probability, given what has already been observed. Prediction intervals are often used in regression analisys like the one i’m presenting here.

I drew a straight line on the graph represents the linear regression of the average prices recorded since August 2010. I added a prediction interval represented by the two lines above and below the linear regression. Bitcoin is in a price bubble whenever it goes above the upper deviation, on the contrary we can talk about prices significantly lower when we are under the line of the lower deviation, but so far it never happened for bitcoin to be so undervalued.

I’ve noticed that most of the time, important price swing are similar in size if we use a logarithmic scale to measure them, i have shown in the logarithmic graph the major movements of similar size and i used them to project what could be the next important long term top.

It may be noted that the next top might reach the $3600 price level, just above the current forecast that gives us the second deviation line of the linear regression, a perfect top in a buying climax situation which usually creates the market condition for a rapid fall in the price. At the moment to enter “bubble territory” we need to go above the 1100-1200$ price zone, just above the upper deviation line i’ve plotted on the chart. It is interesting also to note that the April 2013 top at 266$ has been under the upper deviation line while the 2011 top at 32$ has been well above and a true bubble which was followed by a bear market that has brought prices down to $ 2 in November 2011.

Because this market has been stronger then expected i revised my monthly range forecast to:

- Bitstamp: 450$ – 750$

- BTC-e: 430$ – 770$

- BTCchina: 3270 CNY – 5600 CNY

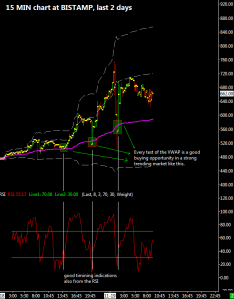

Strong support is always on the VWAP now at 320$-330$ or 2400 CNY.

The bitcoin price reaction from the double bottom at $380 has been very bullish and i believe that we can consider this bottom an important one, at least in the short term. As i pointed out in the previous update the bottom has been very close to the VWAP, which is proving to be a good tool to follow the market when it is both trendy or sideway in a trading range.

The bitcoin price reaction from the double bottom at $380 has been very bullish and i believe that we can consider this bottom an important one, at least in the short term. As i pointed out in the previous update the bottom has been very close to the VWAP, which is proving to be a good tool to follow the market when it is both trendy or sideway in a trading range.