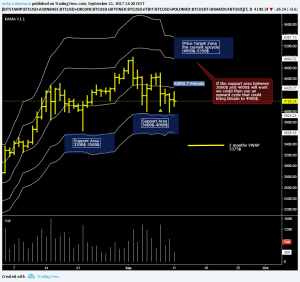

XBT/USD weekly price range at 4000$-4950$ | The price range for this week is not very different from last week, we have seen until now a weak September with the price drop from the all time high of 5000$ and despite several negative news the XBTUSD has remained above 4000 dollars.

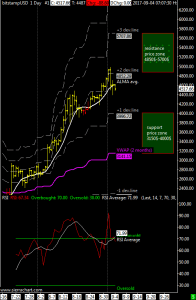

As you can see in the graph the support area using my KAMA indicator ranges from $3600 to $4000, the resistance zone from $4950 to $5350.

If the 4000$ support will work, then an upward cycle with a minimum target of 4950$ could start, otherwise the 2-month VWAP around 3400$ is an important support.

I think it’s unlikely to see bitcoin under the vwap at 2 months for this and also next week, otherwise it would mean that on the weekly chart a medium-long term correction has started; however it’s still early to say and let see if XBTUSD can stay above $4000 this week.