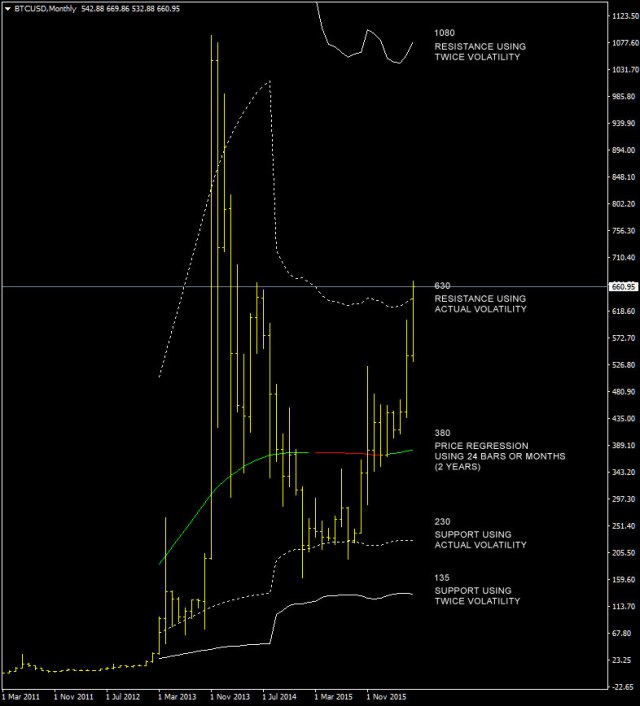

On 18 January 2018, I wrote that the bottom was probably done but I hinted that at the break of the same I would have closed my long term position, unfortunately there was a subsequent very strong selling activity after a weak reaction from the support of the weekly chart (at about 9500$). In these cases it is useful to scale the time frame to the next one (from weekly to monthly), so i applied the KAMA average and its deviation lines to the monthly graph instead of applying them to the weekly graph.

The resulting graph is this at the moment and the market has reacted strongly from this support area.

You can see that the first deviation line has hold the price from further lows at the end of the 2014-2015 bearish market, the same negative deviation line reported to date is at about $ 5300 and the market, for now, has done a bottom at $ 5900. I’ts difficult for me to say if the bearish market started in December 2017 is over, I remain convinced that we will hardly see stable prices under $3900 and that the support area from $3900 to $5300 will be very strong for this year.

If during ther year the trend of the Kama average becomes bearish from flat we will have a confirmation that a down trend, even on the monthly chart, has been established and this would undermine a little the validity of the support area indicated in the chart.

For now I think that the market is still stronger than the 2014-2015 period and that any medium-term correction should be above the indicated support area.