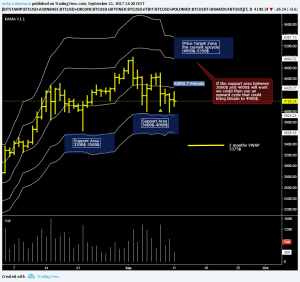

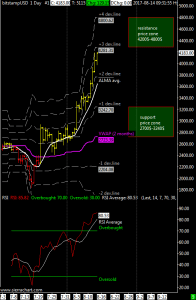

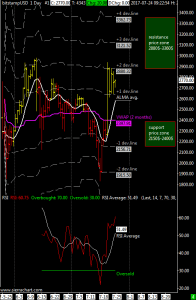

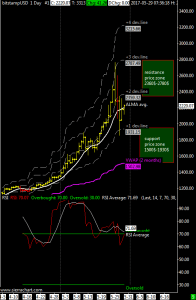

XBT/USD weekly price range at 3650$-4300$ | As I wrote on twitter the market found support within the support area of my previous update that had a lower limit of $2800. I would like to point out that I will not increase my long-term position opened between 2014 and 2015, but I will tell you when there will be a buying opportunity.

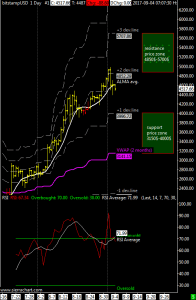

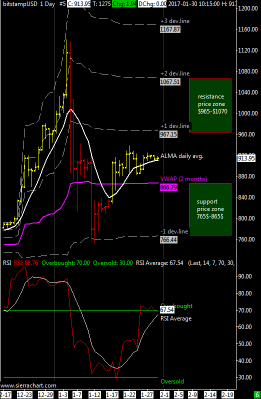

Today’s reaction is positive and I believe that in 1-2 days the ALMA moving average will turn upwards together with the average of the RSI oscillator.

The RSI has already given a purchase signal, but it is better to confirm it when its average slope will also turn positive.

When these conditions are met we will have a buying opportunity.