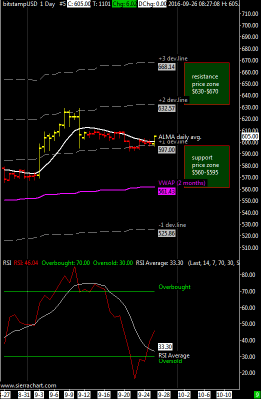

XBTUSD cross has finally break through the first resistance above the mid-line of the price channel now at $640, same price level of the 2 month VWAP. In the attached chart I highlighted the price zone where I expect the next top will fall.

I believe that the next top will fall in this price zone, precisely between 770 and 910 US dollars; because of the long-term trend still up i think that bitcoin could make a maximum higher than the previous one of June, it is not excluded a Top around $ 900 as shown in the weekly chart.

What if i’m Wrong

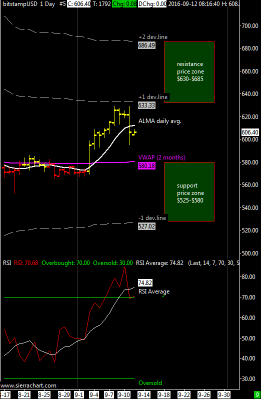

It exists the possibility that i’m wrong if the dominant timeframe isn’t the weekly.

So what? Well we can switch to another timeframe for example the monthly chart. Here the price channel is much wider then the weekly chart, midpoint is at around $500 usd and the two positive deviation lines are at 870 and 1500 usd. Again we have a resistance similar to the weekly chart, around 870-900.

In order to prove that my weekly scenaro is wrong XBTUSD have to break above 900 usd with strong volume, as you know a High-Volume Breakout signal a move higher possibly to $1000 and beyond.