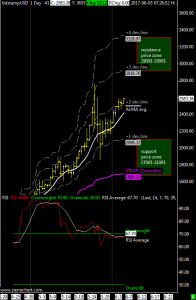

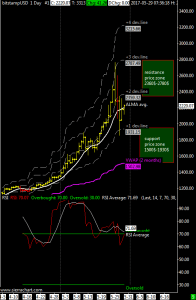

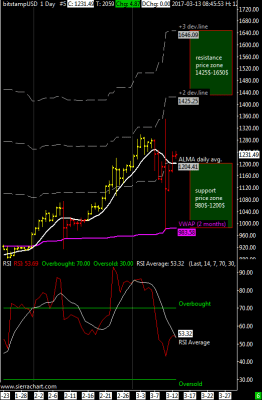

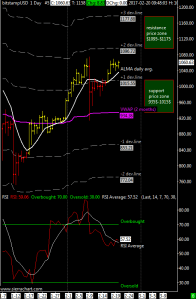

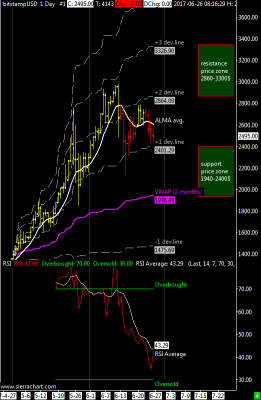

XBT / USD Weekly Price Range is 1940$-2860$ | The Cross XBTUSD is retracing and I think it might reach the VWAP average at 1940$.

However, we must not forget that bitcoin remains in a strong position as long as it remains above the mid-term VWAP and in any case it must break down the 2400$ level (first positive dev.line) to confirm the short-term bearish trend.

The scenario for a new top at $ 3400 has been postponed and for now my January forecast of a maximum yearly excursion to $2900 is turning out to be correct.

As for the altcoins in general, I can say that we will see a general implosion of all altcoins, I’ve recently posted on twitter a mid-period level analysis for litecoin with the “KAMA v1.1” indicator that you can find on tradingview.com

To conclude, the average of the RSI oscillator is approaching the oversold zone and I believe that a buying opportunity might materialize over the next weeks.

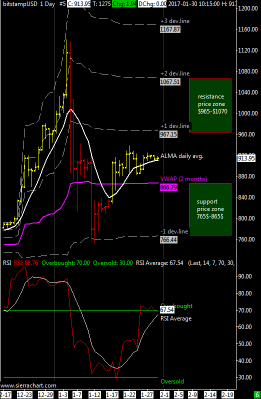

In case of extreme fall, the support area is updated to $ 1100-1400.

ITA Version here.