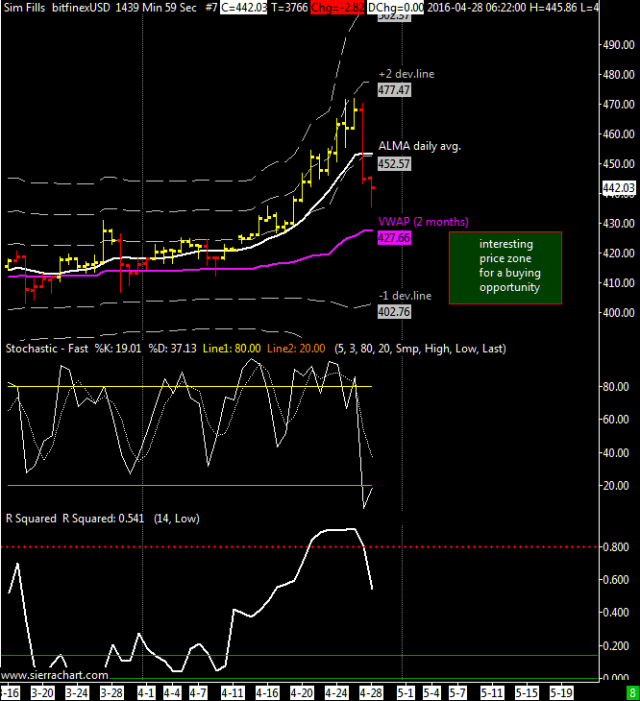

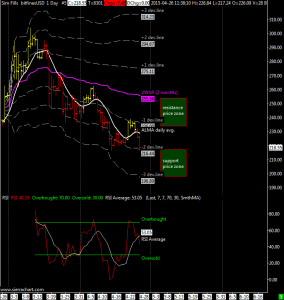

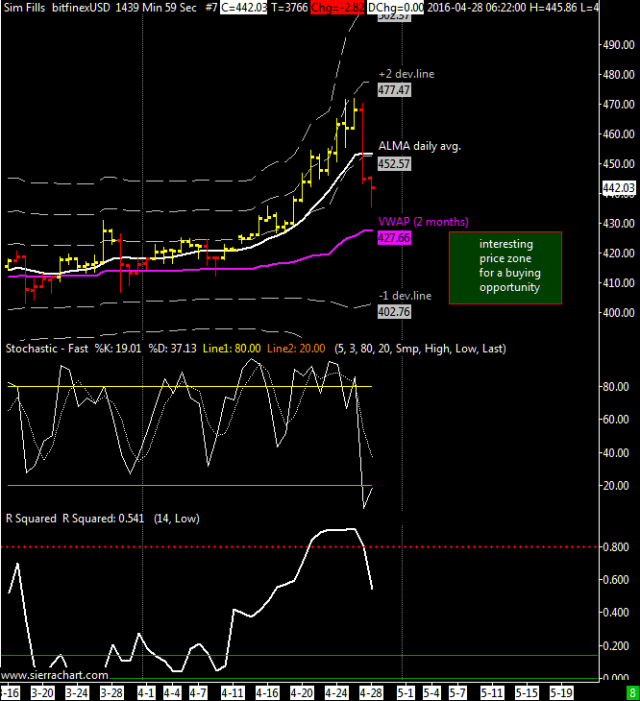

A major drop pulled XBTUSD right above my 2 months VWAP thus for now we are not going to see a stronger up move near $500. However the market might rebounce from here as happened many times in the past after a strong correction the VWAP provided support. I think that could be smart to buy at or slightly below the VWAP between $400 and $425.

In the attached chart i replaced the RSI with a Stochastic oscillator with standard settings, moreover i added the R-Squared indicator that often is useful to understand what is going on.

R-Squared

What the hell is RSquared?:) Well R-squared is a measure of association and it measures the proportion of explained variation between the linear regression and the underlying data it is tracking. For a trader this means that the r-squared calculation identifies how much closely the linear regression indicator matches the price movement. The higher the r-squared value the greater the correlation with the trending component of price.

The length of lookback parameter (14 periods in the above chart) chosen plays a role in determining the numeric level at which r-squared assumes a positive correlation with the underlying linear regression and price movement at the statistical 95% confidence level; the shorter the r-squared length, the higher the r-squared level needed. In our case a 14 period reaches a positive correlation at the 0.27 level, while a 50-period only needs to exceed a 0.08 level.

R-squared moves on a scale from zero to one. A rising r-squared indicates strength of association with a price that is trending, while declining r-squared readings suggest a weak or weakening correlation between linear regression and price, in this case the price is simply moving sideways without the presence of a trend.

In the above chart you can see that when r-squared is stalling above 0.80 a possible top is near but this doesn’t mean the price is going to crash because another option is the price moving sideways right below a top.

A stochastic oscillator is useful as a timing tool to enter short or long when the r-squared is saturating above 0.80.

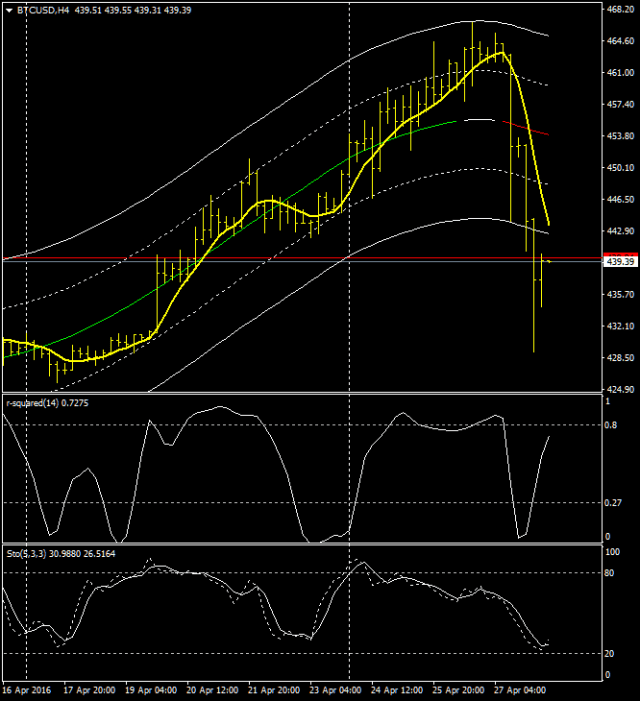

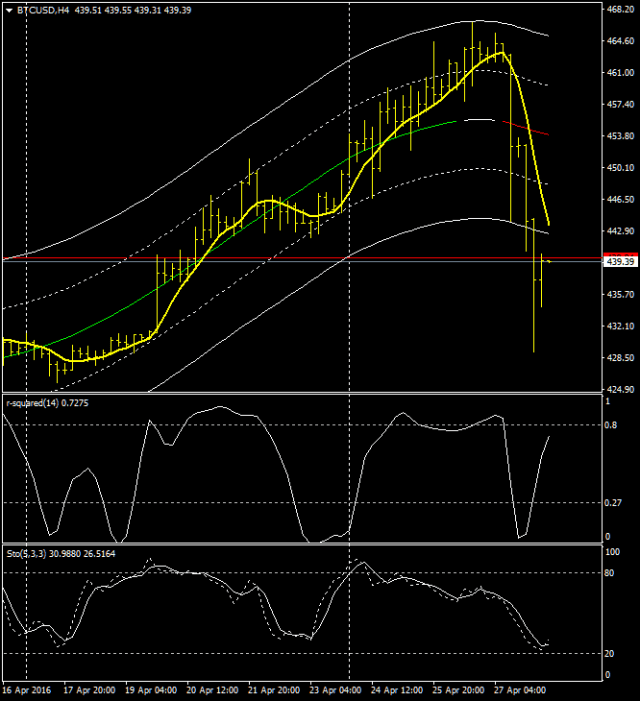

Another view of stochastic and r-squared with an intraday chart

This is an H4 chart of XBTUSD, you can clearly see the cycles of the r-squared moving above 0.27 (0.27 because i’m using 14 periods for the indicator) and 0.80. It is clearly visibile the price going sideways when the r-squared is stalling above 0.80; now the r-squared is again approaching 0.80 signalling that the strong downspike is probably near the end togheter with the stochastic oscillator near oversold territory.

The yellow line is the ALMA moving average, other lines are a way to do a regression of the price and deviation lines to build a price channel.

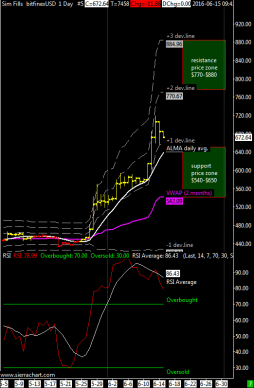

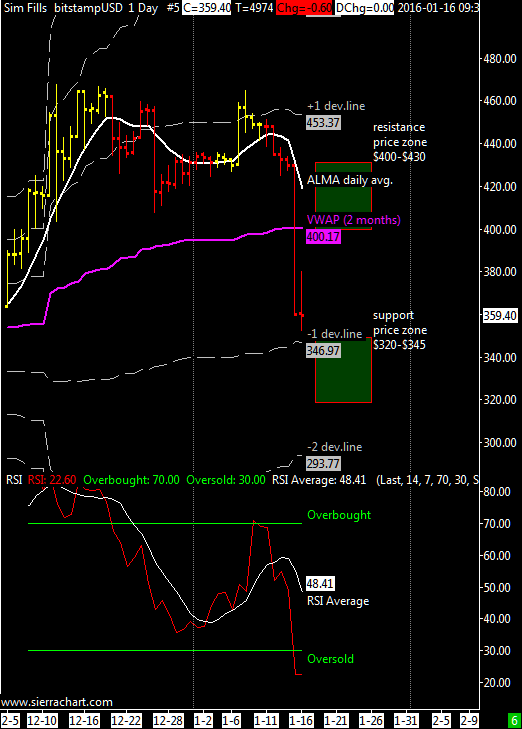

The updated chart shows how the VWAP dynamic support (calculated with two months of data) coincides with an old resistance now turned support. I think this will be a key support to be observed in the coming days and will tell us if the bullish move has finished or not.

The updated chart shows how the VWAP dynamic support (calculated with two months of data) coincides with an old resistance now turned support. I think this will be a key support to be observed in the coming days and will tell us if the bullish move has finished or not.