Every beginning of a new year i post an outlook using entropic methods explained in the technical section of this blog. Here you can find the 2015 and 2016 forecast update, where you can find more information about this approach.

Updated values for bitcoin (in brackets values of last year)

|

BTC/USD |

| Growth Factor G |

1.000722 (1.000166) |

| Shannon Probability P |

0.519 (0.515) |

| Root mean square RMS (see this as volatility) |

0.045 (0.053) |

Bitcoin’s entropic values versus the Usd improved a bit in 2016, with volatility that is dropping and a larger value for the growth now 0.000722% compounded daily or 30% yearly growth up from 6% of 1y ago. Also the optimal fraction of your capital to invest in bitcoin improved in 2016, to minimize risks you can invest in bitcoin up to 6.4% of your total wealth.

| 2017 Price forecast |

Full volatility |

Half volatility |

| Forecast using only G* |

~1235$ |

~1235$ |

| Upper bound adding volatility |

~2900$ |

~1900$ |

| Lower bound subtracting volatility |

~520$ |

~800$ |

*1320 is obtained with today price (around 950$) times (1.000722^365)=~1.30

950*1.30=1235, just change 365 with the number of days you prefer for a different forecast.

Conclusions

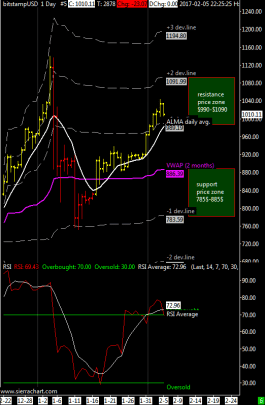

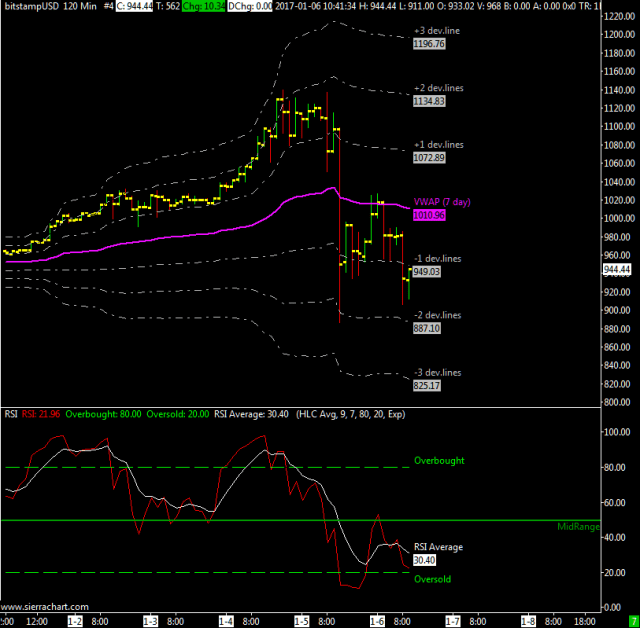

Also for this year i recommend to consider the support/resistance levels obtained with a halved volatility value with the result to have for the whole 2017 a good probability to stay inside the 800$-1900$ price zone with a strong support at around 520$ in case of panic selling.

At the same time i think that at the end of a strong buying climax period, if any, it will be difficult to see the price of a bitcoin over 2900$.

I want also to emphasize the fact that year after year the volatility of Bitcoin is falling although it’s not yet at the level of traditional investment assets like stocks, neverthless this is a good sign and it tells us that bitcoin as an investment asset is improving.

To give you an idea consider that the volatility of the SP500 index is 6 times less then Bitcoin and a stock like Apple is 3 times less volatile then Bitcoin. Keep in mind that during the 2013 peak bitcoin volatility was twice what it is now.

I’m at your disposal for any questions; see you at the next update and Happy New Year!