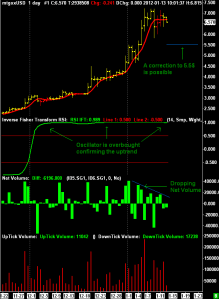

This is a short term view of the last 50 days (the distance between two vertical dotted lines is one month), after the first strong up swing the market is fighting to go above 7.2 and to stay above 6$. I’m not going to keep my short term trade for the long haul yet because as i already said i want to see a confirmed buy signal even on the monthly chart.

This is a short term view of the last 50 days (the distance between two vertical dotted lines is one month), after the first strong up swing the market is fighting to go above 7.2 and to stay above 6$. I’m not going to keep my short term trade for the long haul yet because as i already said i want to see a confirmed buy signal even on the monthly chart.

As you can see in the chart even the net volume is dropping signaling that strong buying is going out of steam, i think that a drop to 5.5$ is possible before resuming the uptrend; in any case for who want to give a try i recommend to apply a stop loss under 5.5$ and sell at the resistance around 7$.

4.8$

4.8$