We have just seen a 3 day break and the question is whether or not it is just the first stage of something bigger. It is hard to tell at this juncture because the at the moment the bitcoin has not even matched the size of the drop of last end of August when it dropped 1.54$, from 12.68$ top of 3 days ago it would give support around 11.14$ a bit below my initial stop of 11.95$.

If a bigger drop is indeed underway then i think it will be similar to the January-February 2012 break from 7$ to 4$ when the market lost 60% of its value, in this case a drop down to 7$ or so.

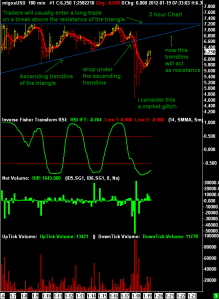

For the moment, i decided to lower my stop loss to 11.14$ and give the market few more days to see if it will rebounce from here, looking the net volume i don’t see a larger aggressive selling activity compared to the previous one of the 28 August drop (marked in the chart with the first rectangle).