There is not much to say, as i said many times it’s hard to forecast the behaviour of few large bitcoin investors, when they decide to sell there is not much support in this tiny market, given the low liquidity (yes,despite mtgox is the biggest exchange i consider it a small market without much liquidity). So far the market is holding above the short term VWAP after a sell off of roughly 35k bitcoins; i think i’m going to close at loss this trade if i see a decisive break of that level (114$).

Category: Short Term Trading

Short term Trade: H8 chart at MtGox

Since last update BTC/USD rised up to my first resistance at 137$ and fall back to support at the first deviation line. The volatility is remaining at low level and because of this i’m going to keep open this trade, i’m confident the price will stay above my entry point at 123$. I’m trying to carry this short term trade up to 145$-150$ where i’ll probably sell.

Since last update BTC/USD rised up to my first resistance at 137$ and fall back to support at the first deviation line. The volatility is remaining at low level and because of this i’m going to keep open this trade, i’m confident the price will stay above my entry point at 123$. I’m trying to carry this short term trade up to 145$-150$ where i’ll probably sell.

For who has followed my last trade i think that is up to to you how long to carry this trade before exiting because every trader has his own unique money management strategy, so if you are unwilling to risk more just close at profit now at around 130$:)

Short term Trade: H8 chart at MtGox

This is a view of last 10 days, each bar represents 8 hours. VWAP levels and deviation lines are computed using last 30 days. I’ve bought on a price breakout at 123.4$, after a normal retracement above the vwap the BTC/USD has resumed the rise. I think the first strong resistance will be around 137$ at the first deviation line, the second one is at 150$, a more serious resistance to be broke with some difficulties. The volatility dropped to very low level and i consider it a good thing for the overall stability of the currency; with current level of volatility it will require time to reach 150$, at least one month. For this week support stands at 120$ and resistance at 137$.

Short Term Update

This is a short term view of May, as usual i added the VWAP and deviation lines. After two failed attempts to break the upper channel line at 121$ the market is now consolidating in a narrow range around 115$. Despite this congestion phase i think that BTC/USD is preparing a new upside move, why?

This is a short term view of May, as usual i added the VWAP and deviation lines. After two failed attempts to break the upper channel line at 121$ the market is now consolidating in a narrow range around 115$. Despite this congestion phase i think that BTC/USD is preparing a new upside move, why?

Well, i’ve learned in many years that positive reaction to bad news tells you that investors sentiment is bullish because they minimize bad news and emphasize good news. The ability of Bulls to maintain a sequence of higher lows (bottom at 79$,97$ and 104$ after the bad news of MtGox in USA) does suggest a major move to the upside. A breakout of 120$-125$ resistance price zone will probably convince me to open a new trade.

To conclude it’s always hard to say on which direction BTC/USD will break but i must consider that the underlying long term trend is still UP. Thus, i’m tempted to say that this price congestion will probably resolve in an upside breakout of the vwap upperline.

Short Term Update: Holding above support

BTC/USD formed a double bottom at 120$ on the hourly chart, and it is reacting well, as long as it stays above the VWAP at 114$ i’m not worried.

If another quick flash crash will take place i recommend to watch out the 75$-80$ price zone where i think BTC/USD will find support and react strongly; that price zone is around the minus one standard deviation of April volume weighted average price. It is a very improbable occurrence a test to the -2 standard deviation line at 50$, so for the remaining part of April and probably till mid May, BTC/USD will stay away from fifty dollars.

Short Term Update: Near resistance

Last 2 days BTC/USD has been very bullish avoiding to fall in a congestion, bitcoin is near the first strong resistance i’ve since the 50$ double bottom. A first evidence of the bullish behaviour is the strong volume on ask side of the order book, once ask side will become prevalent in the mtgox orderbook i think that another correction will take place, but not as strong as the first one.

Last 2 days BTC/USD has been very bullish avoiding to fall in a congestion, bitcoin is near the first strong resistance i’ve since the 50$ double bottom. A first evidence of the bullish behaviour is the strong volume on ask side of the order book, once ask side will become prevalent in the mtgox orderbook i think that another correction will take place, but not as strong as the first one.

168$ is not only the +2 standard deviation line of April VWAP but also the 50% midpoint of the 266$->54.5$ first correction , i expect some resistance here but for now i’m not going to close my trade.

For who want to play extremely safe, i recommend then to close at 170$ or so.

Congestion?

3 inside bars in the last 3 days, BTC/USD is close to be in a congestion area, the measuring bar for the congestion is the bar of last April, 19.

3 inside bars in the last 3 days, BTC/USD is close to be in a congestion area, the measuring bar for the congestion is the bar of last April, 19.

Usually any time prices close on four consecutive bars, within the confines of the range of a “measuring bar”, you have a congestion. The measuring bar broke also the VWAP from below to above it, a sign that i consider a bullish setup.

On the attached chart i plot the +2/-2 standard deviation line but when volatility drops a bit we can consider also the +1/-1 st.dev.line; the +1 std. deviation line is at 139$, close to the recent high of 136.5$, the -1 std.deviation line is at 75$.

I think that if we are going to see a prolonged period of congestion it is not excluded a visit to 75$ if BTC/USD breaks down out of the congestion pattern, time will tell. For now i stay long with my long term trade, stoploss is under the 50$ double bottom support.

Last comment about the recent spike in volatility, well i never seen before an insane volatility like the one see in the bitcoin market, to give you an idea actual volatility is something like 13 times more then the historical volatility of american stocks, just crazy!

Short Term Update: Daily Chart of April

During the last 24 hours of rebounding prices the net volume turned positive again, sign of a comeback of buyers after a huge 7 days sell-off. Overall volume is at all time high, with more then 500k btc traded at the two bottoms, april 12 at 54.5$ and yesterday at 50$.

During the last 24 hours of rebounding prices the net volume turned positive again, sign of a comeback of buyers after a huge 7 days sell-off. Overall volume is at all time high, with more then 500k btc traded at the two bottoms, april 12 at 54.5$ and yesterday at 50$.

Despite an increasing selling pressure, yesterday the market failed to go below 50$, again this is a sign of buyers coming back and sellers going out of ammunitions. Looking VWAP levels, support stands now at 40$ and resistance at 172$, VWAP is at 110$ and it will be an important test to see if this rebounce just started has enough fuel to go above the VWAP. After 6 consecutive days with lower highs today BTC/USD has broken yesterday top at 84.5$ with an intraday high of 88$.

If sellers will take control again and the market fall below 60$ i shall conclude that BTC/USD is headed at least down to 40$, to the minus 2 standard deviation line of april VWAP levels. We are at a critical juncture that might confirm a long term double bottom for bitcoin.

Short Term Update

Good morning, after more then one day i finally managed to download updated data about mtgoxUSD from bitcoinchart , i’ve now a better picture of what is going on. I think that the correction ended in a severe selling climax bar that normally occurs at market bottom with a total volume of 475k btcs that changed hands, remarkably. The bottom occured just below the minus two standard deviation line of the VWAP (volume weighted average price) the excess below it it’s what i call “last motion”; support is now at 68$, vwap is at 130$ and it’s providing some sort of resistance, upper deviation line is at 190$ where probably this reaction will meet strong resistance. It is very important in the next week to move above the vwap over 130$, otherwise i’ve to conclude that the market temporary reversed to the bearish side as long as it stays under the reference average.

Good morning, after more then one day i finally managed to download updated data about mtgoxUSD from bitcoinchart , i’ve now a better picture of what is going on. I think that the correction ended in a severe selling climax bar that normally occurs at market bottom with a total volume of 475k btcs that changed hands, remarkably. The bottom occured just below the minus two standard deviation line of the VWAP (volume weighted average price) the excess below it it’s what i call “last motion”; support is now at 68$, vwap is at 130$ and it’s providing some sort of resistance, upper deviation line is at 190$ where probably this reaction will meet strong resistance. It is very important in the next week to move above the vwap over 130$, otherwise i’ve to conclude that the market temporary reversed to the bearish side as long as it stays under the reference average.

I conclude this update spending two words on net volume, that i repeat it’s the difference from volume made on an uptick minus volume made on a downtick, i use it to judge the momentum or trend in order to make assumptions about its future price movements. Well, i report a net volume of minus 70k btc on the day low, i’ve seen worse days in the last 2 years, for example last August 2012 during the infamous “pirate40” sell off i remember a net volume of more then -110k bitcoins, another selling climax bar that marked a strong bottom, 7.5$ at that time.

It has been a severe drop from 266$ down to 54$ but i remain confident that the recent bottom will hold. If i’m wrong and the market will persist with its short term bearish behaviour and it will go under 50$ i’ll probably have to close my long term trade from 13$.

Short Term Quick Update

Eighty dollars, my dear followers, is the key support. It has been violated for 20 minutes at MtGox at 2 GMT time, down to 65$, then quickly recovered up to 140$ minutes before the programmed two hours trading alt. Now MtGox is under a severe DDOS attack and trading activity is intermittent but price is holding above 80$. Problem is if it starts to drift lower 80$ it might get enough momentum to break 65$, other exchanges have traded down to 50$ before rebouncing, for now the situation remains fragile and volatile as well.

As long i don’t see prices under 50$ with a strong negative net volume activity i’m not going to close my long term trade opened last december at 13$, i’m still bullish for long term.

UPDATE: 80$ broken, volume activity is very high, i think it’s a record more then 385,000 bitcoins traded at mtgox last 24h, and 650,000 overall considering mtgox,bitfloor,btc-e and bitstamp. 50$ is my next level, i can’t be more accurate because i’m in trouble with sierrachart plugin for bitcoincharts, i’m without charts at the moment.

Short Term Update: MtGox Lag above 1 hour, interesting:)

In the last couple of hours we have seen an extremely volatile market, with a yo-yo behaviour hard to manage for an amateur speculator is easy to get slammed, in such situations sometimes is good to don’t touch and wait and don’t let emotions take over. Aniway, in the above image the market strongly reacted down near the second standard deviation of the VWAP, at 105$, after a severe and chaotic drop, i tend to consider this drop a market glitch because of the high lag due to a problematic trading engine at MtGox.

On a weekly basis, the trend is still up, trading activity is growing and show an good volume activity. The weekly moving average is unaffected by the recent wild swing, the ALMA moving average for this week is at 130$, close to the bottom. The net volume indicates to us that the correction just happened isn’t catastrophic as it might appear looking the price drop from 265$ to 105$. The VWAP is at 150$ and i think that tomorrow the price will stabilize itself above that level.

As a side note i should say that a lag of 4500 seconds isn’t properly ideal, i hope that MtGox fix this embarassing situation as soon as possible, it’s in their interest. It’s simply unacceptable, ridicolous, that the leading Bitcoin exchange doesn’t stop trading operations during severe drops caused by hardware/software failure. It is blatantly obvious that with such an high lag and uncertainty people go to panic selling, MtGox should implement some sort of trading curb, also known as a circuit breaker, where trading will stop for a period of time in response to substantial drops in value.

Short Term Update: daily view MtGox

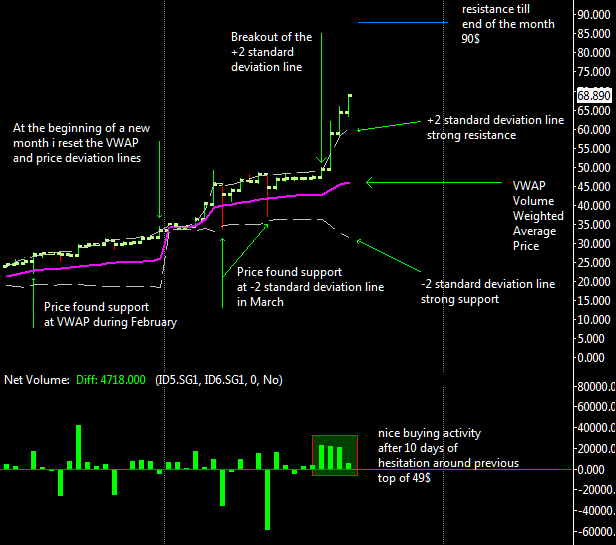

This is a daily view since mid February, 2013.

This is a daily view since mid February, 2013.

It is clearly visible how much strength there is in this uptrend, in the second pane of the chart there is the net volume and i report a nice buying activity after the breakout of the old resistance at 49$, buyers are predominant at all time high and again this is very bullish; usually before any explosive price breakout to the upside there is a period of consolidation and it’s exactly visible on the chart in the 10 days from 7 to 17 March.

The VWAP is the main support level and now it’s at 46$ for this month, the price breakout above 49$ broke the second standard deviation line confirming the nature of the move as an explosive breakout, the target for this month is now at 90$ and i computed it as usual using actual volatility that is 70% higher compared to the level seen in June 2011 top, absolutely remarkable.

For the bears, if there are any outside there:), the first bearish sign is a drop under 54$ then the penetration of the vwap under 46$ should confirm a reverse in the trend.