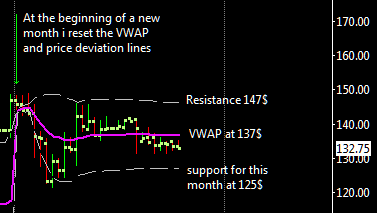

A quick flash crash and BTC/USD is again at around my static support,i think that this drop is temporary and i bet that the VWAP will provide support at 107$ for the coming days. I’m not going to close my half position (50 btc bought at 140$) before a price stabilisation that will occur probably somewhere between here and 105$.

A quick flash crash and BTC/USD is again at around my static support,i think that this drop is temporary and i bet that the VWAP will provide support at 107$ for the coming days. I’m not going to close my half position (50 btc bought at 140$) before a price stabilisation that will occur probably somewhere between here and 105$.

If 105$ will not hold then there are the 2 deviation lines indicated in the chart, 85$ and 62$ where strong buyers will probably show up.

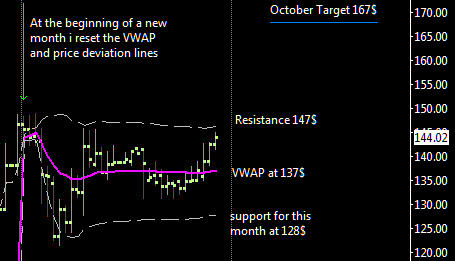

UPDATE October, 3

BTC/USD bottomed out at 109.7$ very close to the VWAP that provided support as i was expecting yesterday, the question now is whether this is a high volume breakout that portends much lower prices, or a high volume shakeout that will quickly be reversed. So far BTC/USD reacted from VWAP back to the first deviation line at 131$ and it is important now to don’t start to drift lower and lower in what i’ll call a secondary reaction that might end at 90$.

Since the market is still above an important moving average i’m plotting since july bottom at 65$ and trending higher since then, I am leaning towards the shakeout theory rather than toward the breakout theory. If I am right we shall see a rally back above the 131$ level during the next couple of days. Should we finish today or tomorrow above 140$ I think a substantial rally will have started.