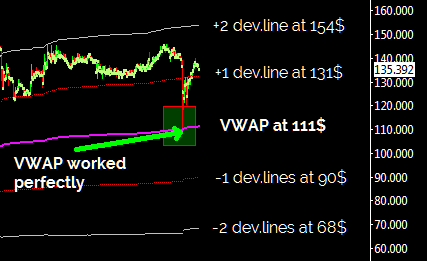

The bitcoin price reaction from the double bottom at $380 has been very bullish and i believe that we can consider this bottom an important one, at least in the short term. As i pointed out in the previous update the bottom has been very close to the VWAP, which is proving to be a good tool to follow the market when it is both trendy or sideway in a trading range.

The bitcoin price reaction from the double bottom at $380 has been very bullish and i believe that we can consider this bottom an important one, at least in the short term. As i pointed out in the previous update the bottom has been very close to the VWAP, which is proving to be a good tool to follow the market when it is both trendy or sideway in a trading range.

I now think that prices will continue to rise until the resistance shown in the attached graph, near $ 1,000.

Weekly range for Bitstamp is 650$-1000$, for BTCchina 4000-6800 CNY and i think it might reach 8500 CNY as target at the end of this month or during December.

Psychologically the threshold of $ 1,000 is a nice goal to reach, as it was to reach in 2011 for the first time a dollar of value. When i started to follow the Bitcoin its value was 30 cents and it seemed to me that we had reached an incredible milestone crossing one dollar at that time, it is amazing for me to watch bitcoin going to 1,000 dollars of value.