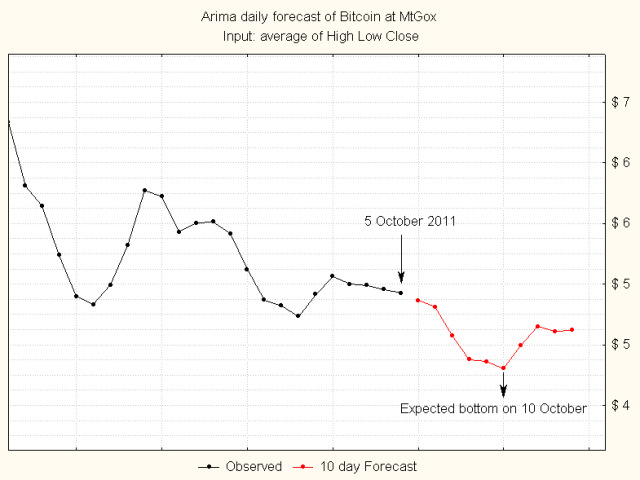

Today after many years i’ve reinstalled Metastock Professional, i was curious to see if there was some old Expert Advisors giving good result with bitcoin and i’ve found this one: “Consolidation Breakout” from Trading Systems Analysis Group.

Basically it works with volatility breakouts to identify entry/exit points and while this system uses John Bollinger’s Bollinger Bands and Welles Wilder’s Average True Range indicator, it is not linked to the methods of those two authors.

It’s based upon a strict observation of the Bollinger Band width compressing/decompressing (a method used by many traders) around the prices until the distance between the upper and lower bands is less than 1 ¾ times the 1 period average true range; it then looks for a breakout in either direction of the Bollinger Bands to capture the movement of the breakout. Once a position is entered, it looks to cross the 20-period simple moving average to exit the position but any other money management approach can be used for the exit.

I attach below the above expert advisor applied to a daily bitcoin chart. It works fairly well when volatility is high enough, even with less volatility performances aren’t so bad without substantial losses.

At the moment the system is flat and exited a short position on 4 Sept. at $231.

I’d like to add that because bitcoin recently has been very boring from now on there will be updates about Currencies, Equities and Gold, all instruments that i trade regularly with my btc broker since September 2012.