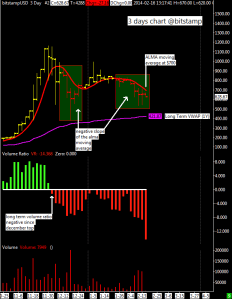

In the last days XBT/USD started to break below the long term VWAP (~$445) and if it makes further downside progress the breakout will become very obvious.

In the last days XBT/USD started to break below the long term VWAP (~$445) and if it makes further downside progress the breakout will become very obvious.

It would probably be followed by a move down to the old April 2013 Top at $266 confirming the giant descending triangle that it is forming.

Such a breakdown would be very bearish IF accompanied by a dropping network difficulty as happened in 2011 during the bear market.

As you can see in the attached chart that on the two previous tests of the VWAP (December bottom at 382 and february bottom at $400) the market reacted strongly and quickly instead this time it is spending too much time around the same support, this is an indication that probably XBT/USD is going to break below it.

In case of a confirmed break below $440 for this week support level should be around $330-$350, i don’t think that XBT/USD will go straight to 266$.

So far I have been talking about bearish potential. There is still a chance (probably 20%-30%) that this potential will not be realized and that new bull market highs lie ahead if XBT/USD stays above long term VWAP. In case of a reaction from here first resistances are at $550-$580.