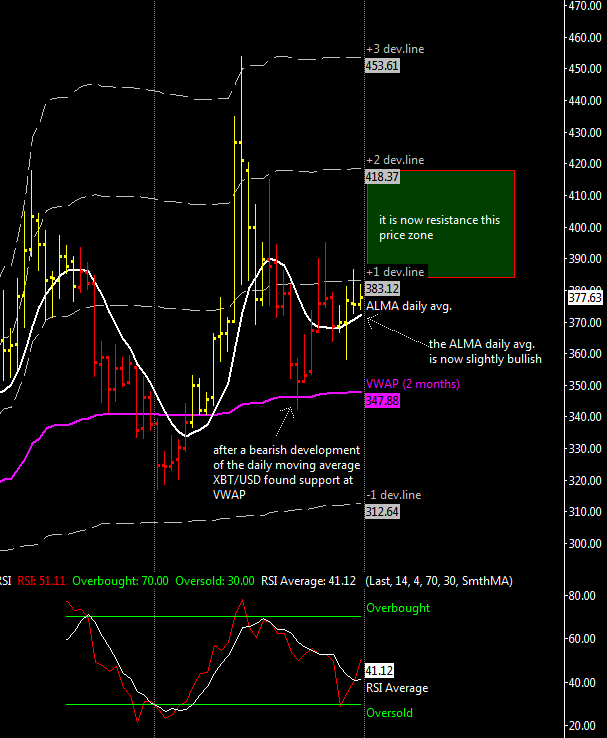

In my last tweet i’ve said that support is at ~$315 let see in detail why.

I indicated in the above chart a strong support area for the next 1-2 weeks, XBT/USD is now again bearish because XBT/USD took a peek below the 2 months VWAP support zone at ~350$. I think the market will spend most of its time today and the next days above or at $315 and if it does then the 316$ November low probably ended the drop from 463$ on November 13. Despite the prolonged correction seen in 2014 I see no sign that the very long term bull market has ended (bitcoin is well above the 2013 average price) and in any case I expect the XBT/USD to hold above its previous 2013 top at 266$.

In case of a move below $315 a problematic scenario could develop with the possibility of my old bearish scenario to materialize (a quick visit to 230$ or so). I Expect buyers to show up below 300$ but in this market the volatility is unstable and can increase very rapidly making it difficult to make predictions on where the bottom will be.