For doing this forecast i used the ARIMA or Autoregressive Integrated Moving Average. It is a statistical analysis model that uses time series data to predict future trends. It is a form of regression analysis that seeks to predict future movements along the seemingly random walk taken by a financial time serie by examining the differences between values in the series instead of using the actual data values.

This model type is generally referred to as ARIMA(p,d,q), with the integers referring to the autoregressive, integrated and moving average parts of the data set, respectively. In this case i used 1 set of autoregressive parameter p, 1 integrate d, and 1 moving average parameters q.

ARIMA modeling can take into account trends, seasonality, cycles, errors and non-stationary aspects of a data set when making forecasts, because of the absence of a proven bitcoin seasonality cycle and/or other cycles i ‘ve not included these aspects in the forecast. More info about this kind of regression at http://en.wikipedia.org/wiki/Autoregressive_integrated_moving_average

Here’s the result using as input the weekly prices recored at MtGox, average of High,Low and Close of each weekly bar.

I’ve to add that due to the presence of a strong volatility around the forecasted value we might see wide swings ranging from 3$ to even 8-9$ in the next 3 months or so.

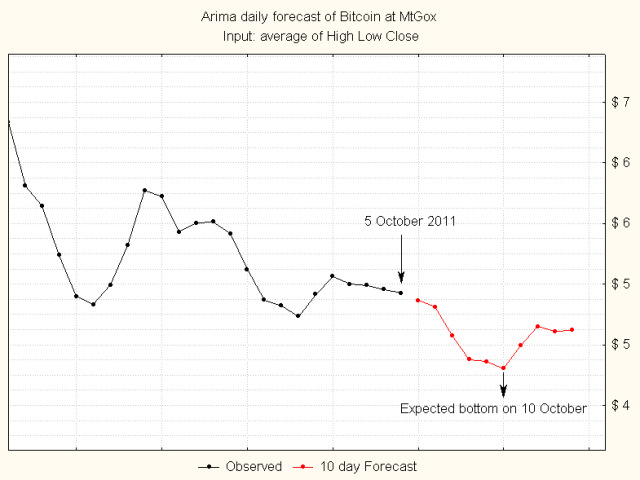

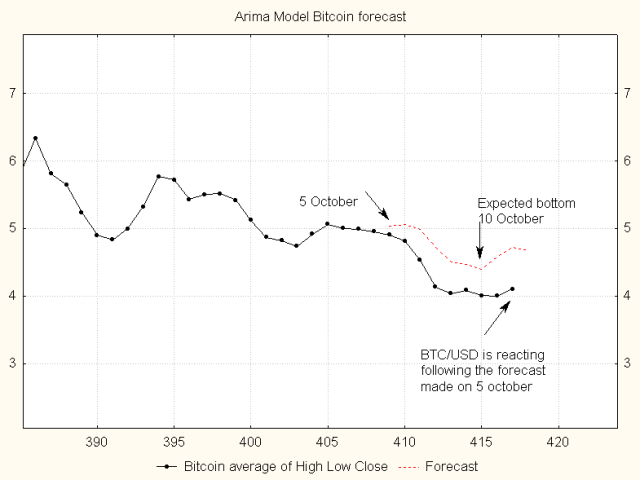

Here you can see an example of this regression technique applied this time to daily data of Mtgox

Will it work? Well only if the bitcoin will follow a 12 day cycle that i included in the forecast, why? i said in the past a couple of time that sometime a 12 days cycle model the bitcoin price movement; without this cycle the forecast is flat around 5$ as it is expected to be considering the last month spent around that level. The effect of the 12 day cycle is not so strong as you can see in the attached chart, at max it might push the price down only to ~4.5$

I’ve to conclude saying that the internal dynamic of bitcoin price time serie is not enough good to allow consistent and reliable forecasts (due to the lack of strong and consistent cycles) with these regression techniques, the confidence level of each forecast i made is very wide due to the presence of a strong volatility that diminish the usefulness of the forecast itself.

This imply that the best trading strategy for the short term is to buy the dips and sell at the first bounce instead of relying on some sort of cycle forecast, and i think that this is what many traders at MtGox are already doing:)

Thanks and see you at the next update.

Initially i thought about a break down of the 2$ big support, but BTC/USD after a huge selling climax bar reacted to 2.47$, i now have to reassess my view giving 2.8$ as next target. Usually when a big downside bar develops its starting point become resistance and in this case the resistance is the 2.8$-3$ zone.

Initially i thought about a break down of the 2$ big support, but BTC/USD after a huge selling climax bar reacted to 2.47$, i now have to reassess my view giving 2.8$ as next target. Usually when a big downside bar develops its starting point become resistance and in this case the resistance is the 2.8$-3$ zone.

4.8$

4.8$