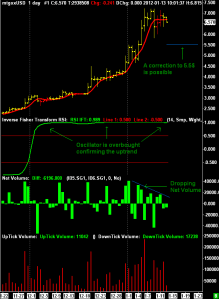

This is a weekly view since october 2011. It is visible the November low at 1.94$ and the recent top at 7.2$, in the second pane of the chart there is the net volume and it’s clearly visible how it moved from a positive situation to a negative one. The weekly ALMA moving average has now a downward slope, confirming this phase as corrective.

This is a weekly view since october 2011. It is visible the November low at 1.94$ and the recent top at 7.2$, in the second pane of the chart there is the net volume and it’s clearly visible how it moved from a positive situation to a negative one. The weekly ALMA moving average has now a downward slope, confirming this phase as corrective.

I think that the underlying long term is still intact, despite a month of selling pressure the price isn’t crashed to 2$ or even lower, i’ll evaluate to open another short term trade when i’ll have bullish indications from the 4hours and the daily chart.