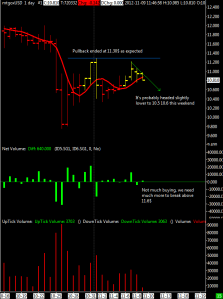

BTC/USD completed as expected the rebound up to 12.40$ i think that it will remain under it for the remaining part of this week. In my previous update i’ve said that i’d have considered a buy above 11.3$, well i’m not too much convinced for a mid term up movement because of the upcoming block halving date (it’s expected to happen tomorrow), it’s the first time that such event happens and i think that there is an high expectation by investors to see an increase in price, this is the main reason that let me think that this expected rise have already been discounted and when the halving block will happen it’s not excluded a serious drop.

BTC/USD completed as expected the rebound up to 12.40$ i think that it will remain under it for the remaining part of this week. In my previous update i’ve said that i’d have considered a buy above 11.3$, well i’m not too much convinced for a mid term up movement because of the upcoming block halving date (it’s expected to happen tomorrow), it’s the first time that such event happens and i think that there is an high expectation by investors to see an increase in price, this is the main reason that let me think that this expected rise have already been discounted and when the halving block will happen it’s not excluded a serious drop.

In any case i’ll probably try a short term trade if the market retraces down to the previous resistance of 11.3$-11.5$ after the halving block date, if a more serious drop will take place i’ll stay out.