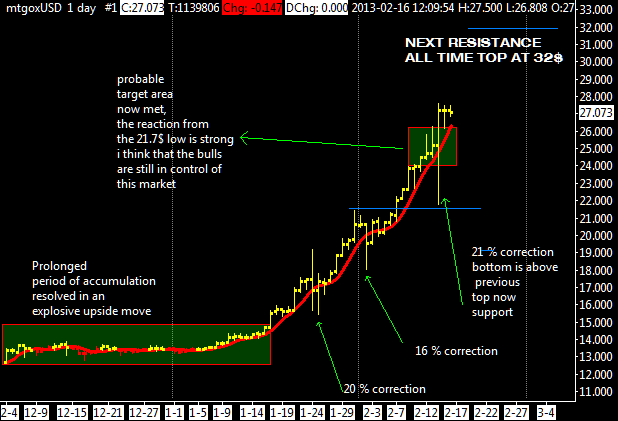

In the last couple of hours we have seen an extremely volatile market, with a yo-yo behaviour hard to manage for an amateur speculator is easy to get slammed, in such situations sometimes is good to don’t touch and wait and don’t let emotions take over. Aniway, in the above image the market strongly reacted down near the second standard deviation of the VWAP, at 105$, after a severe and chaotic drop, i tend to consider this drop a market glitch because of the high lag due to a problematic trading engine at MtGox.

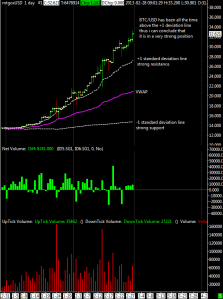

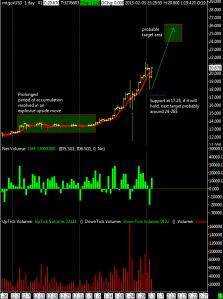

On a weekly basis, the trend is still up, trading activity is growing and show an good volume activity. The weekly moving average is unaffected by the recent wild swing, the ALMA moving average for this week is at 130$, close to the bottom. The net volume indicates to us that the correction just happened isn’t catastrophic as it might appear looking the price drop from 265$ to 105$. The VWAP is at 150$ and i think that tomorrow the price will stabilize itself above that level.

As a side note i should say that a lag of 4500 seconds isn’t properly ideal, i hope that MtGox fix this embarassing situation as soon as possible, it’s in their interest. It’s simply unacceptable, ridicolous, that the leading Bitcoin exchange doesn’t stop trading operations during severe drops caused by hardware/software failure. It is blatantly obvious that with such an high lag and uncertainty people go to panic selling, MtGox should implement some sort of trading curb, also known as a circuit breaker, where trading will stop for a period of time in response to substantial drops in value.