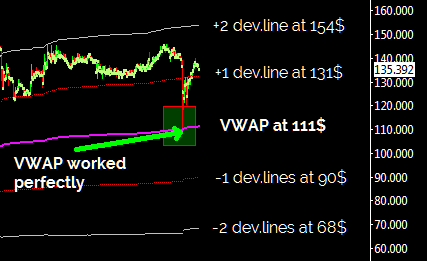

Yesterday there was the first serious profit taking by investors of this strong advance in price started in late September. In these cases it is very important that the average VWAP stop the fall of prices and in fact it worked perfectly despite the large volumes that occured at Bitstamp , about 50000 bitcoins .

Yesterday there was the first serious profit taking by investors of this strong advance in price started in late September. In these cases it is very important that the average VWAP stop the fall of prices and in fact it worked perfectly despite the large volumes that occured at Bitstamp , about 50000 bitcoins .

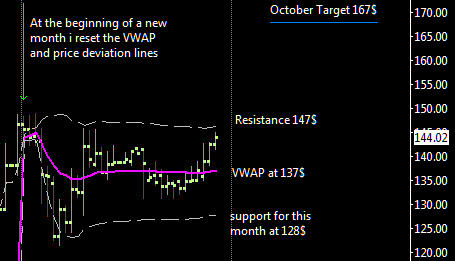

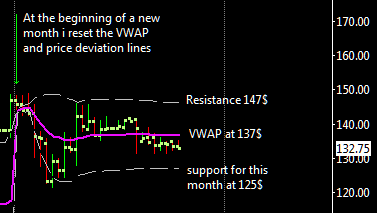

At this point it is very important to stay above 270 dollars and possibly to react from here up to the second statistical deviation line of the VWAP located at 410 dollars,it would be a good top for November. It takes a lot of strength to go up further and it is very likely that we can drop during the next week down to $ 200, which i consider a very strong support and very important not to violate it.

For now I am waiting for further developments before taking a decision for my open trade , in the case of a break of $ 200 i will be practically forced to close the position to avoid to violate a fundamental rule of trading : do not to allow a profit to turn into a loss; it is very easy to fall in this mistake in a volatile market like this where winning trades can quickly turn into losses.

See you at the next update, and good trading .