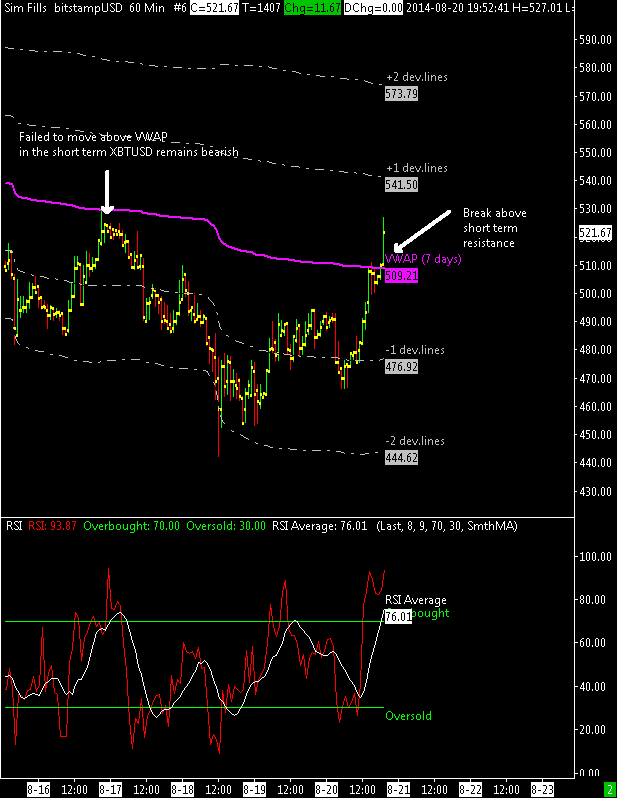

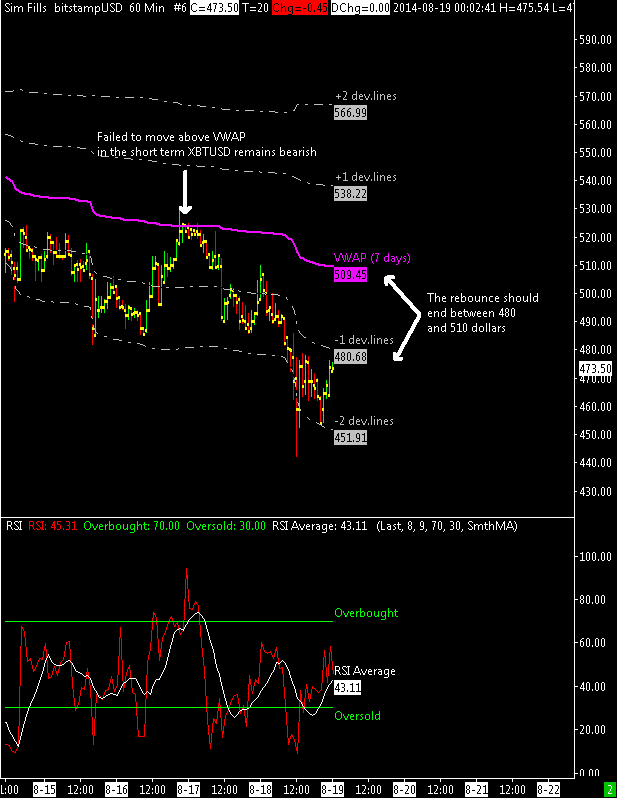

Since my last update this market has bounced twice towards my short term volume average, this happened after the Paypal news about adding bitcoin support. The price zone from $455 to $465 is still working as support, any break below $455 would materialize my bearish scenario down to $420. The current daily cycle is still pointing there, to $420.

Paypal news is just the latest in a long series of positive news for the bitcoin environment but the market hasn’t reacted positively to these bullish news for many months, not to mention the null effect of Dell accepting bitcoins. This is definitely an abnormal behavior and it can only be explained by the low level of those who trade at the main bitcoin exchanges, they lack also of long term view on bitcoin and are here merely for short term speculation.