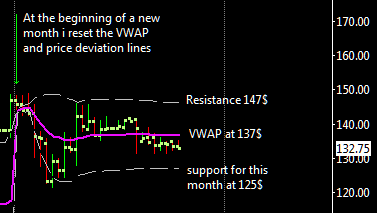

As you can see from the attached chart on the left BTC/USD at gox is again probing the static resistance at around 147$.

As you can see from the attached chart on the left BTC/USD at gox is again probing the static resistance at around 147$.

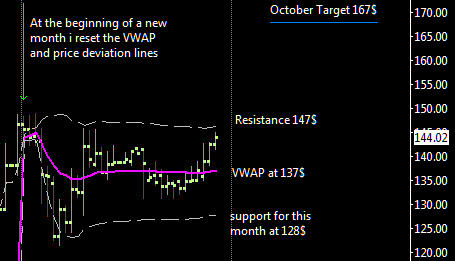

It is clear from the chart that an ascending triangle pattern is forming with a projected target of 165$ that it’s exactly my long term target i’ve spoken about in this update . I think there is a chance to breakout September top at 149$ and reach 165$ or so during October.

I’m particulary happy of the recent news of a private Bitcoin Investment Trust for accredited investorst launched by Secondmarket, this might affect price significantly next year. Unlike the ETF that the Winklevoss twins have been trying to do, this one is only available to accredited investors and so it doesn’t have to pass the same exploratory process that a wider ETF would need to go through complex regulatory procedures. I can’t be sure but i smell a new big wave (the third after 2011 and 2013) of investors coming in 2014-2015, why? Well the bull market is coming to an end and instead of holding overvalued stocks many investors will eventualy explore new kind of investments like cryptocurrencies and Secondmarket Bitcoin Trust could be an easy gateway to invest in bitcoin.