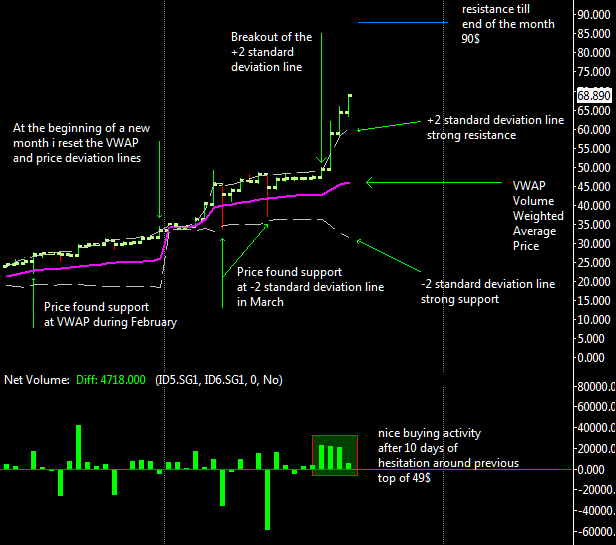

This is a daily view since mid February, 2013.

This is a daily view since mid February, 2013.

It is clearly visible how much strength there is in this uptrend, in the second pane of the chart there is the net volume and i report a nice buying activity after the breakout of the old resistance at 49$, buyers are predominant at all time high and again this is very bullish; usually before any explosive price breakout to the upside there is a period of consolidation and it’s exactly visible on the chart in the 10 days from 7 to 17 March.

The VWAP is the main support level and now it’s at 46$ for this month, the price breakout above 49$ broke the second standard deviation line confirming the nature of the move as an explosive breakout, the target for this month is now at 90$ and i computed it as usual using actual volatility that is 70% higher compared to the level seen in June 2011 top, absolutely remarkable.

For the bears, if there are any outside there:), the first bearish sign is a drop under 54$ then the penetration of the vwap under 46$ should confirm a reverse in the trend.