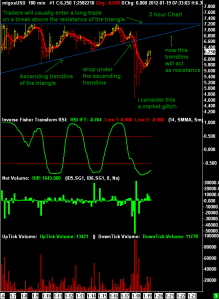

In my last update i wrote about a potential down move after the breakdown of the ascending triangle (shown in the previous update) as usually happens when such triangle is broken to the downside.

In my last update i wrote about a potential down move after the breakdown of the ascending triangle (shown in the previous update) as usually happens when such triangle is broken to the downside.

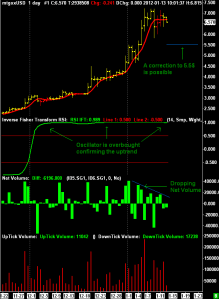

The market rebounced to the trendline to 6.6$ as i was expecting before dropping again and there i ‘ve thought for a while about liquidating my position but i didn’t do it, my mistake.

At this point i think that BTC/USD might drop again to 5$ or even 4.5$ in the next week, in the case of a clear drop under 4.5$ i’m forced to liquidate my position opened at 3.22$ 2 months ago; why? well you should never allow an unrealised profit to turn into a loss:)