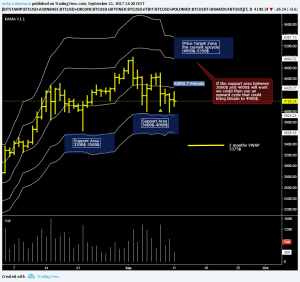

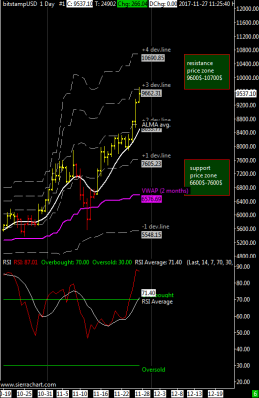

XBT/USD weekly price range 7600$-10700$ | The 2-month VWAP is now at 6600$, the resistance zone ranges from 9600$ to 10700$ and is defined by the 3rd and 4th price deviation line.

XBTUSD begins the week at a resistance level, however this pair has proven that it is not impossible to reach the fourth positive deviation line above VWAP, it has already happened on November 8th.

The support area ranges from 6600$ to 7600$ and is defined by VWAP and the 1st deviation line.

In the event of a strong profit taking, I think it is very difficult to see a test down to the VWAP at 6600$, given the enormous strength of this market is much more likely that the support level at 7600$ will hold.

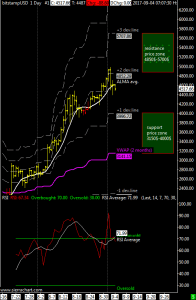

The RSI oscillator is clearly overbought with its average just above the threshold level of 70; these two conditions do not preclude a further boost of the market up to 10700$.