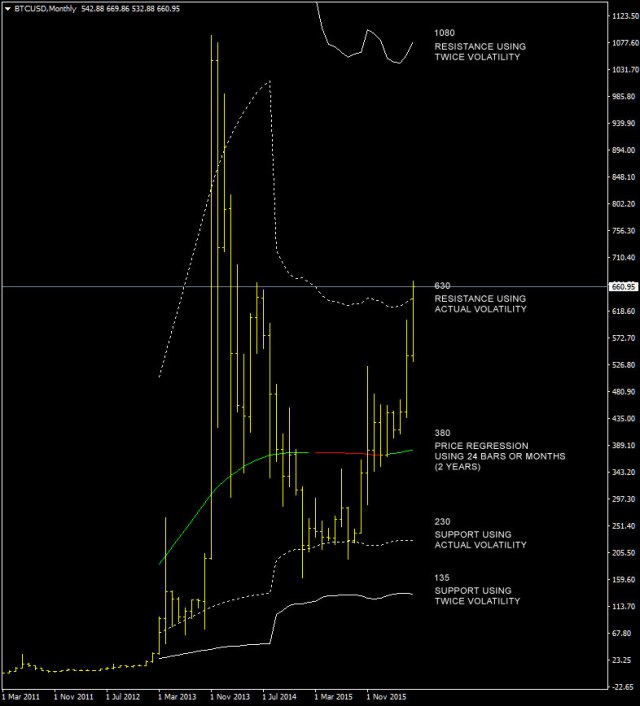

This is a template i use with metatrader 4 where you can see a price regression channel. Yellow line is the same average i use on sierrachart, ALMA moving average.

The dotted deviation lines are calculated using the volatility derived from the average true range indicator. The solid deviation lines are calculated with the same approach but using two times the value of the average true range. Most of the time XBTUSD stays inside the dotted deviation lines but during period of high volatility it moves towards the solid deviation lines as happened in the last Top of June at $780.

With the bitfinex flash crash XBTUSD tested the first lower deviation line at $475 although on some exchanges the bottom touched $460. I don’t think is over yet, there might be a secondary reaction that can last all this month and maybe part of September with a test of the lower deviation line, this price level is near $400 as indicated in the chart.

The color of the mid-channel line represents the strength of the trend, red if bearish, white for neutral and green if bullish, at the moment the main trend is bullish and it’ll not change if XBTUSD doesn’t move below $400 for a prolonged period of time. I’m not going to liquidate my position as soon XBTUSD stays inside this long term bullish price channel.

As usual this article is available also at steemit.

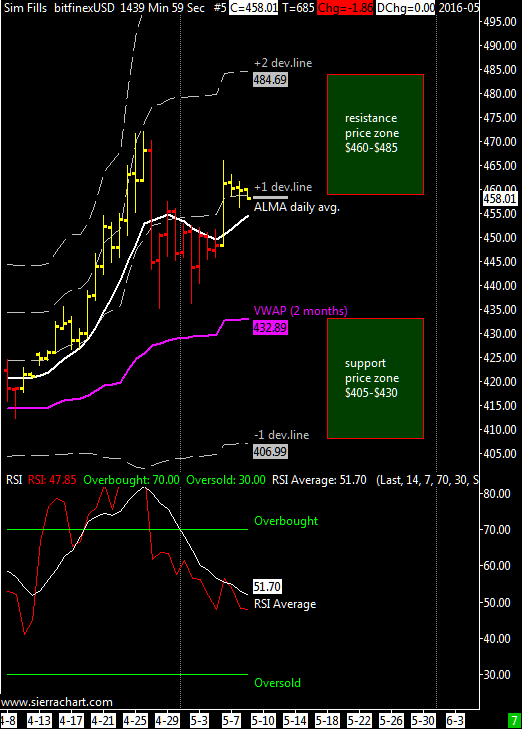

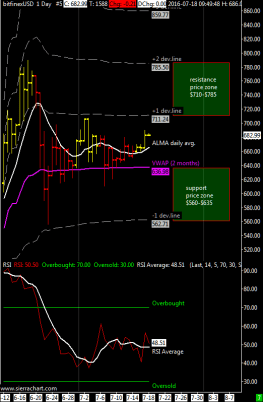

XBT/USD weekly range.forecast $610-$800 | daily moving average is firmly bulllish and main support is at VWAP near $520 although when the market is strong usually the first positive deviation line act as main support; now at $615.

XBT/USD weekly range.forecast $610-$800 | daily moving average is firmly bulllish and main support is at VWAP near $520 although when the market is strong usually the first positive deviation line act as main support; now at $615.