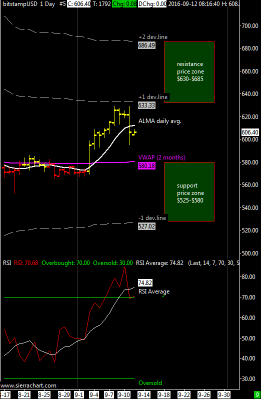

XBT / USD weekly price range is 865$-965$ | The XBTUSD cross has moved above the VWAP regaining a position of strength, for this week the main resistance is the price zone between the first and the second deviation line or the 965$-1070$ price range; This technical rebound should stop in this price range (970$-1070$ ) now we need to wait to see where will be done the next relative maximum to understand how it is positioned in the medium term, given the situation of the weekly chart I expect that the next top will be lower then the other one of 3 January done approx at 1170$.

As support it is valid the first negative deviation line VWAP at around $ 765 although I feel that the last minimum done at $750 is confirmed and i think to be right considering now the VWAP at 865$ as main support for this week and probably the next one.

The daily RSI oscillator average has reversed to the upside but without going into oversold first, thus great buying opportunities have not yet been materialized.

In cases of extreme fall the support area run from 590 to 680 USD.

ITA version here at bitchanger.com