XBT/USD weekly price range 6800$-8600$ | This week the 2-month VWAP updates to 6100$ from last week’s 4800$; new data is replacing the old ones and it may happen that you have some slight changes on the price level of the reference average.

The resistance zone ranges from 8600$ to 9800$ and is defined by the 2nd and 3rd deviation line of the 2-month VWAP.

The support area ranges from $6100 to $6800 and is defined by VWAP and an intermediate level between the VWAP and the 1st deviation line.

I think it is very difficult to see a test down to the VWAP at $6100, if there were to be some profit taking the market should not fall below $6800, considering that the RSI oscillator turned upside without testing the oversold area i still believe that this market will go over 8000$ eventually after a small correction towards our first support at 6800$.

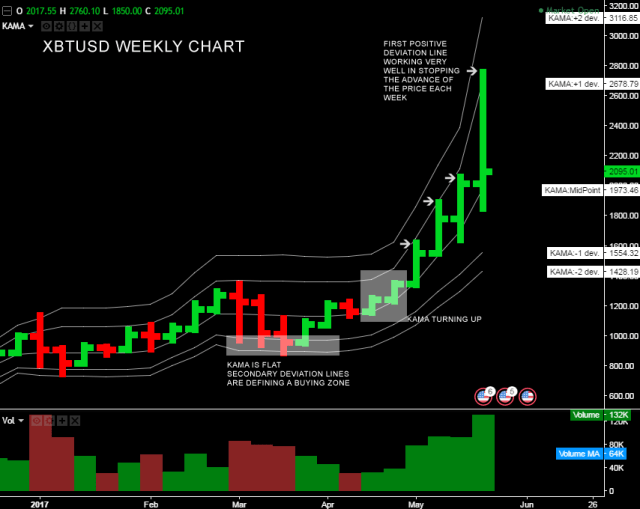

The other template I use on Tradingview with KAMA average and deviation levels is very similar to this one; the weekly KAMA is at 5800$ not far from the 6100$ of the 2-month VWAP.

The resistance zone is 8000$-9300$, slightly lower than the one presented with this update of 8600$-9800$.

Basically we have a decent correlation between the two templates (VWAP using Sierrachart and KAMA using Tradingview. com)

In the event of an unexpected catastrophic news, the support area on the weekly chart is updated to 3200-4000 USD.

ITA Version Here.