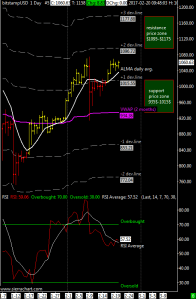

XBT / USD weekly price range is 2400$-2880$ | The XBTUSD cross resists over 2400$ support but as I said last week there is always a risk that it breaks down towards the 2 months VWAP roughly at $1950.

With the ALMA daily moving average pushing bitcoin down and its effort to stay above 2400$ there is some sort of compression also visible in the chart as a symmetric triangle (descending tops and ascending bottoms), as I have said several times in the past this pattern usually forms during a trend as a continuation pattern thus it should end with an upside breakout.

To conclude, the average RSI oscillator is in neutral zone near 50 and the RSI itself has stopped falling without ever entering the oversold area below 30.

In case of a catastrophic event the support area is 1150$-1450$.

Follow me also on Twitter where I started tweeting charts about bitcoin and some altcoins too using the TradingView.com platform

ITA Version Here