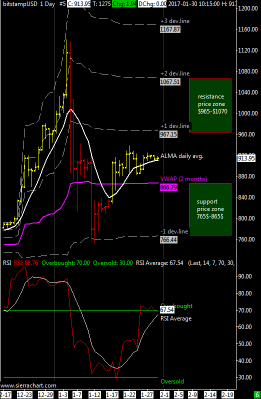

XBT / USD weekly price range is unchanged at 865$-965$ | The XBTUSD cross remained above the VWAP and you can see in the attached chart that a price congestion is building up around $ 910; also for this week the main resistance is the price zone between the first and the second VWAP deviation line line between 965 and 1070 usd.

About support the VWAP is still valid and flat since several weeks, around 865$.

The average daily RSI oscillator is approaching the overbought zone, i’ll observe carefully this market once the oscillator has come into this area (RSI above 70-80).

In cases of extreme fall the support area ranges from 600 to 700 USD.

Italian version here at bitchanger.com