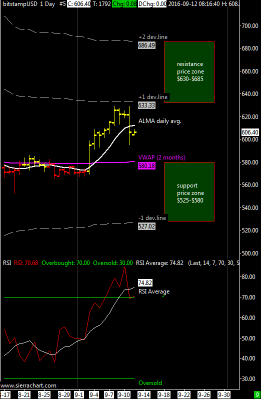

XBT / USD weekly price range forecast 750$-855$ | The main resistance is the VWAP at 855$ and because this market dropped below it for the first time in months we can consider the cross XBTUSD in a weak position and the top at 1140$ done on January 3 is confirmed; to understand how it is positioned in the medium term our beloved BTC’s we need to see where the next bottom will be done.

As support is valid the first negative deviation line of the VWAP at around 750$ although I feel that the next minimum might be around 640$ or the second negative price deviation line of our mid-term VWAP .

In the previous update I wrote about my doubts if the VWAP at 850$ would have hold a second time the decline from the top after stopping that drop already once; the market indeed fell further but remained inside the support area that I indicated at that time.

The average of the RSI daily oscillator has finally drop near oversold levels, not giving a buy signal yet.

In cases of extreme drop support is price area between 580 and 660 USD.

Italian version here at bitchanger.com