It is always better to look, as I always say, at larger time frames to understand how to build a winning operating strategy. I invite you first to look at this monthly chart of the BTCUSD, before commenting it.

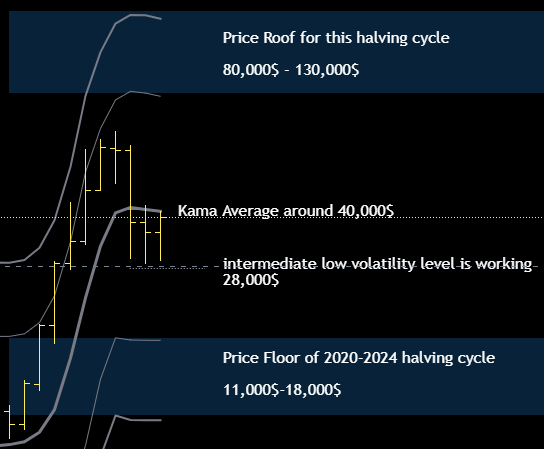

We are clearly compressed in a price range well defined by the monthly average that defines the equilibrium point of this halving cycle (2020-2024) and an intermediate level with reduced volatility (around $28,000).

A Failure to move and to stay above the monthly Kama average would be bearish in my opinion and it would clearly be followed by a decline to the support zone of this halving cycle, between $11 and $18K.

With a confirmed break of the monthly average above $40,000 then the view would change and bitcoin would return to a position of strength that should bring it towards the resistance zone located between $80 and $130,000, in accordance with what I wrote in January in my “2021 outlook with entropic methods” where upper bound level was 121,000$

Bitcoin and the top of the previous cycle rule

Because of this rule i’m very skeptic to see bitcoin at 18,000$ or even lower inside the support price zone. Bitcoin in its history never tested the price level of the top of the previous halving cycle and if 29,000$ bottom is confirmed this rule will not be broken (29,000$ is above 2017 Top at around 20,000$).

What would a bottom in this cycle below 20,000$ imply? Well, it would mean that bitcoin’s long-term trend is slowing down and we would probably have to wait for the next halving cycle, after 2024, to see a Top above the current one at $64,000. Thus, as i wrote in this post title, we are at a critical point in time to understand what scenario bitcoin will go into.

The Big Picture

Here you can see what I said before, the Top of a halving cycle is always lower than the bottom of the next cycle, I interpret this as a strong bullish signal of the fundamental trend of bitcoin.

To conclude many of you are probably asking why the hell i sold below 29,000$ if there was an intermediate support slightly lower, well once i define a strategy with a trailing profit order i prefer to avoid to continously change it to accomodate what the market does, i had already moved the trailing profit order from 35,000$ down to 29,000$ to contain the volatility of bitcoin and it worked for several weeks then some bad luck damaged me, however this is all part of trading and i’m not upset at all.