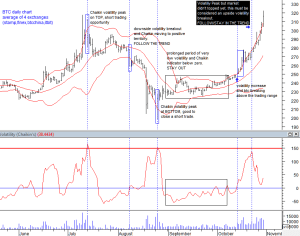

From my previous update: “..About the recent prolonged period of low volatility i’m observing an increased volume activity among all the biggest bitcoin exchanges, this let me think that bitcoin is probably accumulating to later break the trading range and move above $250. This break would be confirmed with a positive reading of the Chaikin Indicator..”

Well at the end it happened and a volatility increase in the right direction moved XBTUSD above the trading range ($210-$245), it is interesting to observe that a very strong volatility peak happened on October 22 but instead of topping this market continued to push upward (observe below chart),

at this point i think that an intermediate top might happen with a second volatility peak probably within November 10th.

at this point i think that an intermediate top might happen with a second volatility peak probably within November 10th.

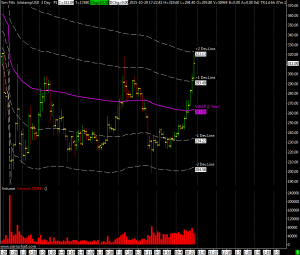

At resistance?

Checking price levels it seems that it’ll be hard to pass $320-$330, the 1Year Vwap is at $264 and the 2nd positive deviation line stands at $323, only %5 chance to move above in the short term despite this i think that a final top might happen at or below $400 before a strong correction will take place. If i’m wrong a strong support lies between the VWAP and $280 (where it happened the first volatility peak).

If you want to support this blog you can open an account at bit4x using my referral link, clicking here . Thank you.