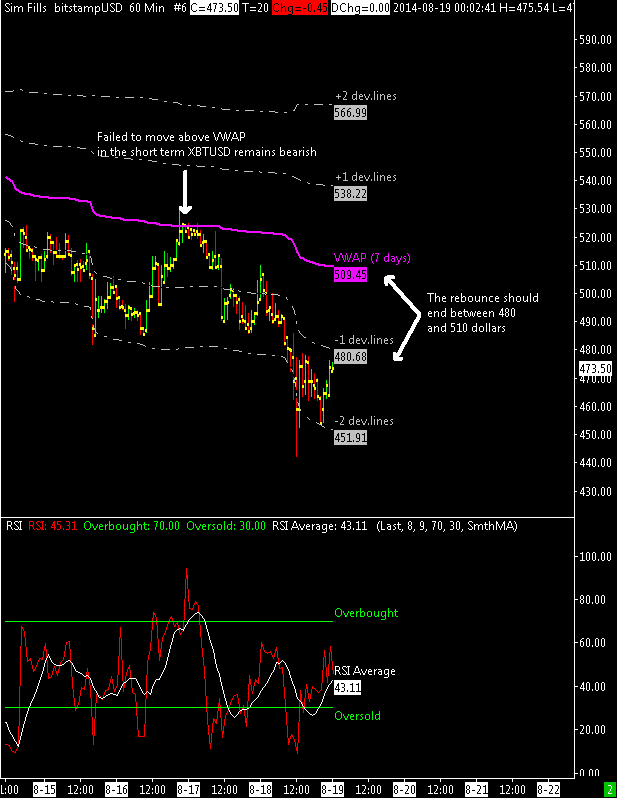

I dunno why, but i’m not surprised to see an heavy selling activity on Sunday, probably too much bored traders at Bitstamp and/or Bitfinex; jokes apart i’m starting to be annoyed by the short term behaviour of this market, totally disconnected from the news with sudden heavy selling activities typical of an immature and unstable market and for unstable i mean the volatility level with its high variance or unpredictability as main characteristic.

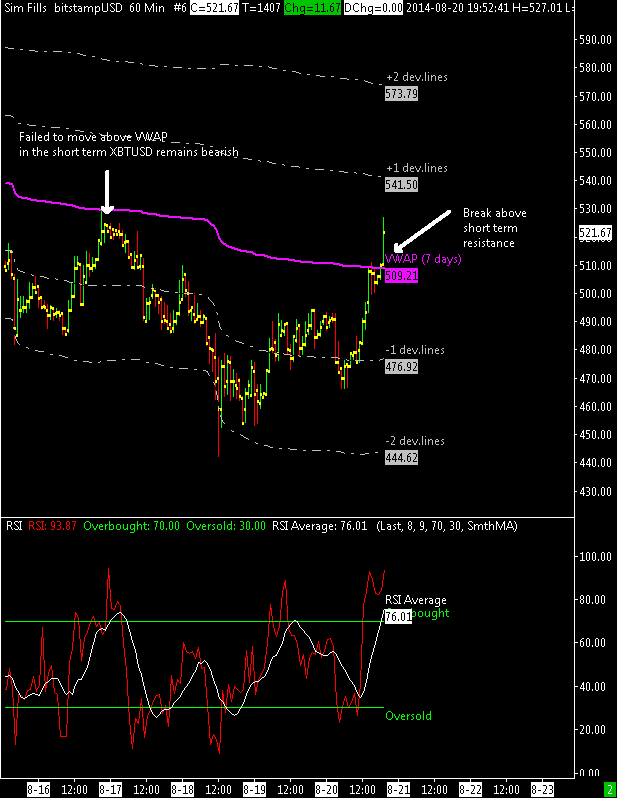

Aniway $495 has been broken and now it will work as resistance in case of a rebounce, in the meantime the VWAP is quicly readjusting itself below the $500 mark.

Support for next week should be in the $430-$440 price zone, resistance at around $495-$500.

The question now is whether this is a high volume breakout that portends much lower prices, or a high volume shakeout that will quickly be reversed by a strong reaction with good volumes and the price coming back above $500. Considering the low level nature of the investor community at the biggest bitcoin exchanges, personally I am leaning towards the shakeout theory rather than toward the breakout theory, it’ll be important to see how it’ll start the next week, the first 2-3 days.