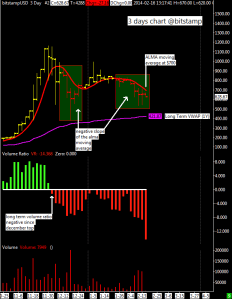

BTC/USD is trading beneath its 50 day moving average today as I write this, that average is now at $780. Coupled with the high volume on the downside, especially in the last 10 days, this is solid evidence for a reversal of the short term market trend from up to down.

BTC/USD is trading beneath its 50 day moving average today as I write this, that average is now at $780. Coupled with the high volume on the downside, especially in the last 10 days, this is solid evidence for a reversal of the short term market trend from up to down.

I think that BTC/USD will drop 200 dollars from here down to the long term support, my long term VWAP calculated using last one year of data.

If I am right about this the prognosis calls the bottom should develop as a conseguence of the MtGox drama, that exchange (if we can call it an exchange…) is almost out of business, my guess is that it is down of bitcoins and with strong manipulations of the price they are trying to recover the money lost due to the malleability issue from their own customers, this practice is of course totally illegal in a regulated market, i don’t want to go in the details but looking MtGox price and volume data there is a strong evidence of such activity.

Back to our long term chart, is this the start of a bear market? I think it is too early to tell. The 200 day moving average is around my long term VWAP so a drop under it would be the first clue that a bear market has begun. Also the other kind of average i use, the ALMA moving average, turned negative during the prolonged trading range of January.

I added a new indicator, similar to my “net volume” indicator, the only difference is that it computes the ratio between buyers and sellers and it has been remarkably accurate staying in bearish territory since November top; it looks good as a trend following tool.

For the short term i think the price is now in a congestion in the $520-$720 price zone, a strong bottom where to shake out all weak hands is necessary and very healthy in my view and if this event will be accompanied by MtGox going out of business indefinitely, then the bitcoin market will be ready to move up again.