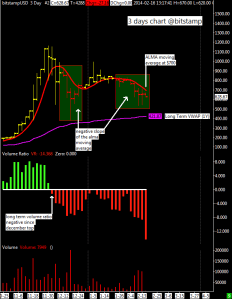

I attached here on the left a long term chart where each bar represents three days of market activity, as i said in the past this particular time frame is a good compromise between a weekly chart and a daily chart.

I attached here on the left a long term chart where each bar represents three days of market activity, as i said in the past this particular time frame is a good compromise between a weekly chart and a daily chart.

Despite the recent strong rebounce from my long term support around $420, the ALMA moving average is still pointing down confirming that XBT/USD is in a short term corrective phase inside a long term bull market because the price during last months has been always above my long term vwap, now at $430 and also above the 200 days moving average now at ~$470 and rising.

About volume activity the “volume ratio” indicator tell us that the situation is still very oversold and all the recent bearish news and the excess of pessimism among many investors let me think that probably the bottom is in but to avoid any risk before opening a long position is wise to wait a positive volume activity that should be back once a new uptrend is established and confirmed by the reversal to the upside of the ALMA moving average i use.

To conclude XBT/USD remains in a corrective phase inside a long term bull market, the rebounce should stop near $600 where there is the ALMA moving average to act as resistance level. Any strength above $600 could mean that the short term bearish trend is over and that this market is headed up again.